03 Apr || what is hedging in trading with example

Hedging in Trading with Example #

Hedging in trading is a risk management strategy used to reduce or eliminate the risk of adverse price movements in an asset. It typically involves taking an offsetting position in a related security, such as derivatives (options, futures, or swaps).

Most Common strataegies :-

Buying Put,

Selling OTM Call,

Creating Option Strategy,

This week NIFTY is going to affect due to Teriff announcement

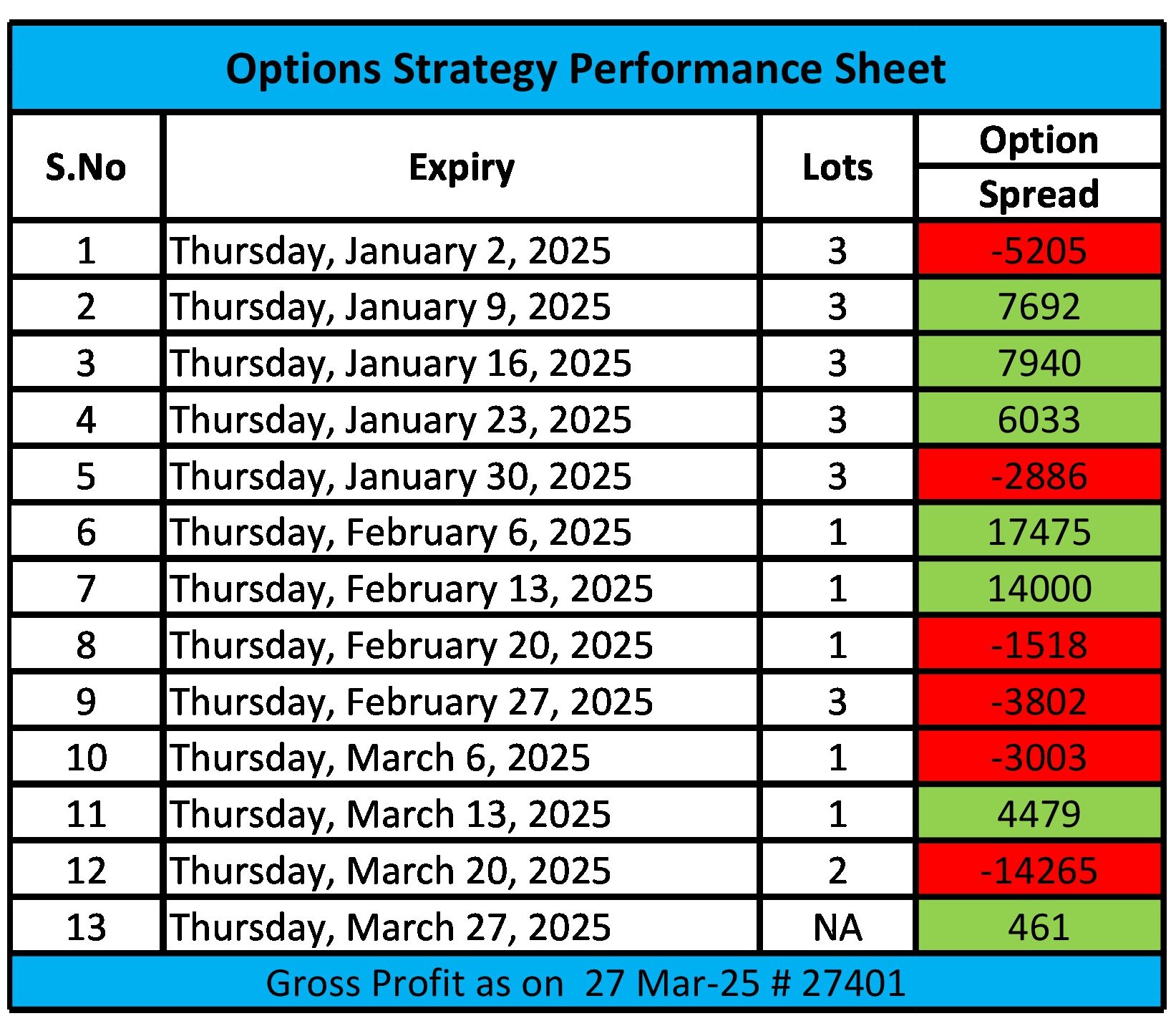

Performance Sheet

Click the under given Link for previous week NIFTY weekly Expiry Trades created for hedging purposes

For 9 Jan Expiry Trade details Click this Link

For 16 Jan Expiry Trade details Click this Link

For 23 Jan Expiry Trade details Click this Link

For 30 Jan Expiry Trade details Click this Link

For 06 Feb Expiry Trade details Click this Link

For 13 Feb Expiry Trade details Click this Link

For 20 Feb Expiry Trade details Click this Link

For 27 Feb Expiry Trade details Click this Link

For 06 Mar Expiry Trade details Click this Link

For 13 Mar Expiry Trade Details Click this Link

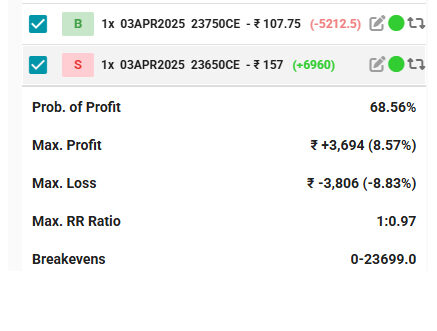

Created short position in NIFTY against My position in NIFTY Heavyweight || For details check under given screensot

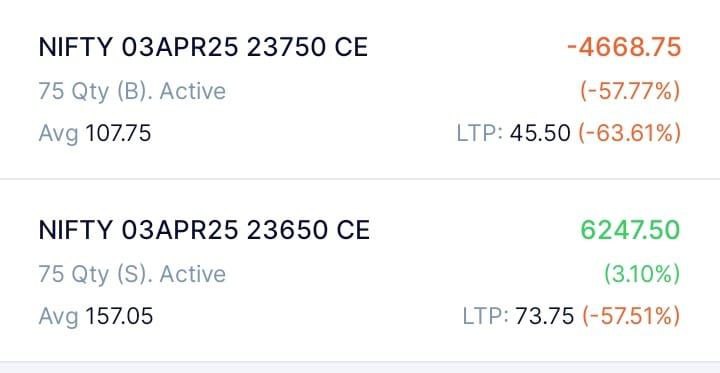

Day-1 # NIFTY was quite volatile today || On closing basis I am having profit of 1500 apx

Day-2 # Market was Closed on account of EID….

Day-3 # NIFTY closed around 23165 || On closing basis I am having profit of 3517 apx

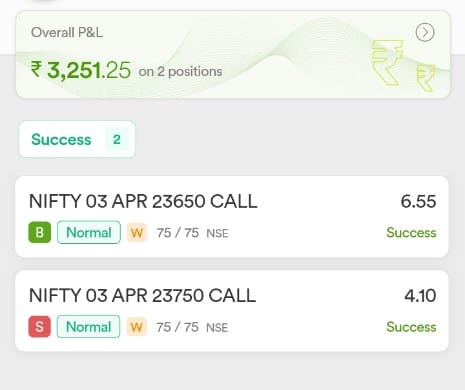

Day-4 # Today I squared off my position and Booked Profit around 3251 || Refer Screenshot