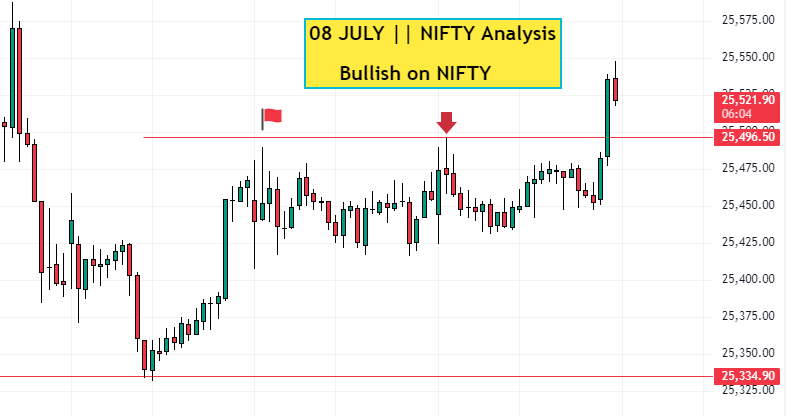

08 July || Bullish view on NIFTY

08 July # Booked Loss in all short position after seeing recovery in NIFTY and now I am having no position in NIFTY for hedging purposes…

For previous Expiry Details click this Link https://tradingkarma.in/bearish-on-nifty-02-july/

9 July | NIFTY Price Action Analysis || Check this Video Link

Today’s market session was a rollercoaster — filled with volatility and mixed sentiment.

In the first half, the NIFTY 50 showed strength, attempting to build a solid base above the 25500 level. However, the second half turned bearish, driven by notable weakness in Reliance Industries, which exerted significant downward pressure on the index.

Despite the sharp decline, the market witnessed a mild recovery near closing, hinting at potential support buying and buyer interest at lower levels.

🔹 My View: I continue to hold a bullish stance on NIFTY

🔹 No positions have been created for hedging at this point

📌 Key technical levels to watch:

Support: 25500

Let’s see how the market reacts tomorrow. Stay cautious, stay informed. ✅

10 July || NIFTY Price Action Analysis – Bulls Struggle Amid Market Pressure

Today’s NIFTY 10 July analysis shows that the Indian stock market faced a tough session, especially for the bulls. Throughout the day, the NIFTY 50 remained under heavy selling pressure, failing to sustain any upward momentum. It was a clear display of weakness across broader indices. However, towards the closing hours, we saw a recovery at lower levels, possibly due to short-covering or value buying.

From a NIFTY price action today standpoint, the index continued to trade within a narrow band, lacking conviction for a breakout or breakdown. Despite the intraday volatility, I still maintain a bullish view on NIFTY over the medium term. At present, I am holding no open positions in NIFTY for hedging purposes, preferring to observe the market outlook NIFTY before re-entering with conviction.

📌 Key NIFTY Technical Levels:

-

NIFTY support and resistance levels to watch:

🟢 Support: around 25300

🔴 Resistance: around 25500

11 July || NIFTY Price Action Analysis || Booked Loss of 249 Points

Bearish View on NIFTY || Key Support Broken

Today marked a significant shift in the market sentiment as NIFTY finally broke down below the crucial 25,300 zone – an important support level that held strong for weeks. This breakdown signals potential weakness, especially on the higher time frame, which hasn’t been witnessed since April 1.

Given the shift in structure, I changed my stance and initiated short positions to hedge my ongoing positional trades. The recent price action reflects increased selling pressure and lack of conviction from the bulls, making it a cautious zone for fresh long entries.

🔍 Key Observations:

-

25,300 zone acted as a strong demand zone, now broken.

-

First major sign of weakness on a higher time frame since April 1.

-

Shifted stance from bullish to bearish with hedged shorts.

-

Volatility may increase; keep a close watch on global cues and sector-specific moves.

Conclusion: With today’s price action, the trend appears to be weakening. Until we see a strong reversal or reclaim of 25,300+, I will maintain a bearish stance with a risk-managed approach.