11 July Bearish on NIFTY

Nifty Bearish view || Key Support Broken

For previous Expiry Details Click this Link

11 July || NIFTY Price Action Analysis

Today marked a significant shift in the market sentiment as NIFTY finally broke down below the crucial 25,300 zone – an important support level that held strong for weeks. This breakdown signals potential weakness, especially on the higher time frame, which hasn’t been witnessed since April 1.

Given the shift in structure, I changed my stance and initiated short positions to hedge my ongoing positional trades. The recent price action reflects increased selling pressure and lack of conviction from the bulls, making it a cautious zone for fresh long entries.

🔍 Key Observations:

-

25,300 zone acted as a strong demand zone, now broken.

-

First major sign of weakness on a higher time frame since April 1.

-

Shifted stance from bullish to bearish with hedged shorts.

-

Volatility may increase; keep a close watch on global cues and sector-specific moves.

Conclusion: With today’s price action, the trend appears to be weakening. Until we see a strong reversal or reclaim of 25,300+, I will maintain a bearish stance with a risk-managed approach. || Check this video link

14 July NIFTY Analysis – Support Holds Near 25000

On 14 July, NIFTY traded weak as anticipated, continuing its bearish momentum. The index found crucial support around the 25000 level, which acted as a strong demand zone during the session. Despite the downward pressure, NIFTY managed to hold above this support, indicating possible consolidation in the near term.

Today’s price action suggests that any upside move above 25200 could trigger short-covering. In line with this, I plan to square off all my short positions above the 25200 mark to protect profits and manage risk effectively.

Traders should remain cautious and watch for price action near key resistance zones. A sustained move above 25200 could signal a short-term reversal, while failure to hold 25000 may invite further selling pressure.

#NIFTYAnalysis #PriceAction #StockMarketIndia #NIFTYSupport #ShortCovering #NIFTYToday #TradingStrategy

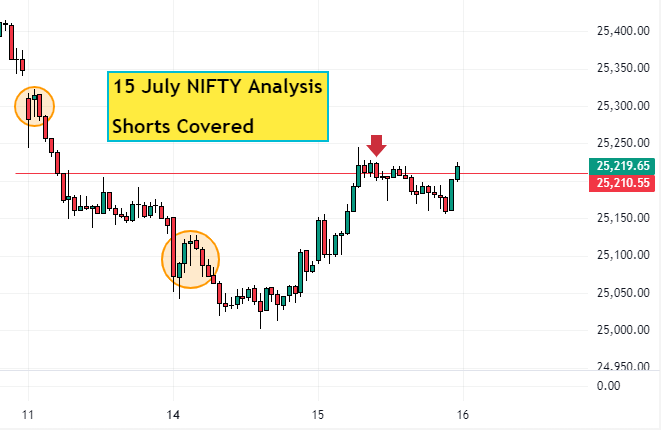

15 July NIFTY Analysis || 15 जुलाई NIFTY विश्लेषण :-

As discussed earlier, I covered my short trade in NIFTY once it sustained above the 25200 level. Going forward, my approach remains “sell on rally” at higher levels unless we see any strong structural shift in the index.

जैसा कि पहले चर्चा की गई थी, मैंने अपना NIFTY में short trade कवर कर लिया जब NIFTY ने 25200 के ऊपर ट्रेड करना शुरू किया। अब मेरी strategy “sell on rally” की रहेगी जब तक NIFTY में कोई बड़ा structural change न दिखे। NIFTY intraday strategy, NIFTY trading tips और NIFTY technical analysis के लिए यह लेवल महत्वपूर्ण रहेगा।