30 May Positional Trade Report

🎯 Positional Trading: A Strategic Approach to Market Mastery

Ever wondered how top traders navigate market volatility? Let’s explore positional trading – a powerful strategy for long-term success.

Key elements of positional trading:

• Hold positions for extended periods

• Utilize technical analysis extensively

• Make strategic adjustments (e.g. call writing, averaging)

• Adapt to changing market conditions

My personal approach:

1. Focus on NIFTY Top 10 stocks

2. Target sector leaders and indices

3. Set fixed profit targets

4. Trade regularly to capitalize on opportunities

💡 Pro Tip: Technical analysis plays a crucial role in identifying optimal entry and exit points.

By embracing positional trading, you can potentially:

• Reduce daily stress

• Capitalize on larger market moves

• Develop a more strategic mindset

Are you currently using positional trading strategies? What’s been your experience?

पोजिशनल ट्रेडिंग रणनीति का अभिप्राय उस ट्रेडिंग फॉर्मेट से है, जिसमें ट्रेडर थोड़े लंबे समय के लिए पोजीशन बनता हैं और बदलती परिस्थितियों के अनुसार Call writing या averaging जैसे adjustment करने के लिए तैयार रहते हैं।

( Technical analysis का काफी important Role होता है ) मेरी पोजिशनल ट्रेडिंग रणनीति के अनुसार मैं एक Fixed Target के साथ नियमित आधार पर निफ्टी टॉप 10 शेयरों or Sector Leader stock or Sectoral Indicies में Position बनाता हूं ।

What is MTF or Margin Trading Facility (MTF सुविधा क्या है) ?

When you use certain amount of yours and raise remaining part from Broker this facility of Fund arrangement is known as MTF

Broker charge interest on the sanctioned amount (interest rate is usually between 9 to 15 %) it all depends upon your Broker and the Plan you are having.

जब आप अपना फंड का उपयोग करने के साथ ब्रोकर का फण्ड भी उपयोग करते है तो इसे MTF सुविधा कहा जाता है,

ब्रोकर इस सुविधा के बदले आप से interest चार्ज करता है जो की 9 से 15 (%) के बीच सालाना दर पर होता है

Last but not least never forget leverage is a double edge sword if you don’t know how to use it then its very dangerous and you can’t expect same amount of MTF on different stocks, it keeps on changing as you change the category of Stock

हमेशा ध्यान रखे MTF सुविधा एक दोधारी तलवार की तरह अगर आपको इसका सही उपयोग नहीं आता तो यह रिस्की भी साबित हो सकती है और हमेशा ध्यान रखे यह सुविधा सब स्टॉक्स पर नहीं मिलती और सब स्टॉक्स पर एक जैसी भी नहीं मिलती ( यानि किसी पर काम किसी पर जायदा और किसी पर बिलकुल भी नहीं)

To know NIFTY Top 10 Stock Click this Link

Click here for 2023 Performance sheet

Click here for 2024 Performance Sheet

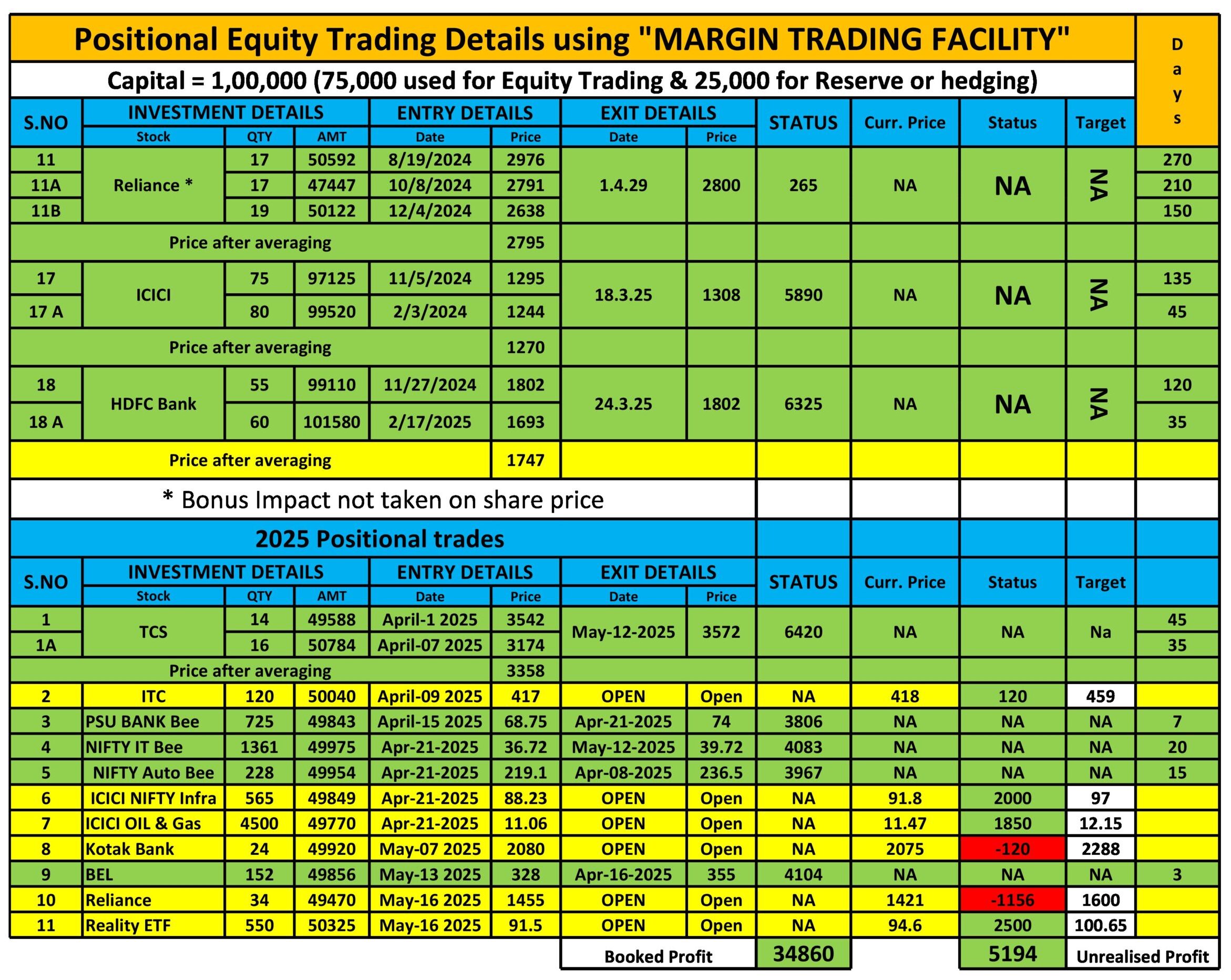

Basic Structure of my model:-

A) CapitalRequired 1,00,000 (or above)

B) Divide this Capital into two parts,

C) Use 75,000 for Positional Trading in NIFTY Top 10 Stocks,Sector Leader or Sectrol Indicies,

D) Use 25,000 for Derrivative Trading,

E) Use MTF for higher return in Positional Trading,

F) Use any Risk defined strategy for Derrivative Trading,

- Please Check the Below given Performance Sheet for Positional Trades…

- Total Trades since Jan-1 2023 # 66 ( 32 + 21 + 13 )

- Average Holding day # 45 Days

- “A” Category Trade ( Profit Booked within 30 Days) # 19 + 6 + 4 = 29

- “B” Category Trade ( Profit Booked within 30 to 60 Days) # 6 + 7 + 4 = 17

- “C” Category Trade ( Profit Booked above 60 Days) # 7 + 8 + 5= 20

===============

Right now I am having open Position in ITC,ICICI NIFTY Infra,ICICI Oil & Gas Indicies , Reliance, Reality ETF and Kotak Bank….

Booked Profit between Jan-1(2023) to 31 Dec-(2023) #76,379

Booked Profit between Jan-1(2024) to 31 Dec (2024) # 47,816

Booked Profit between Jan-1(2025) to as on Date # 34860

Unrealised Profit in Open Position as on May-30 ( 2025) # 5194

Positional Trade Performance Sheet