What is the Lot size of NIFTY || 06 March NIFTY Weekly Expiry Trade

What is the Lot size of NIFTY || 06 March NIFTY Weekly Expiry Trade

NIFTY Lot Size is 75 now, earlier it used to be 25 but after recent changes by the Regulators, it increased to 75. To Trade in One Lot of NIFTY Future one require almost 2 Lakh, with the usage of Hedging Tools one can reduce the margin in a big way.

Lets discuss this week “NIFTY weekly Expiry Trade” Today NIFTY closed around 22540 || created Short Trade in NIFTY against my Long position in NIFTY heavyweight || Sold 22500 CE & Bought 22750 CE || Max Loss # 9150 & Max Profit # 9600 || Breakeven # 22660 || For Details Check Screenshot

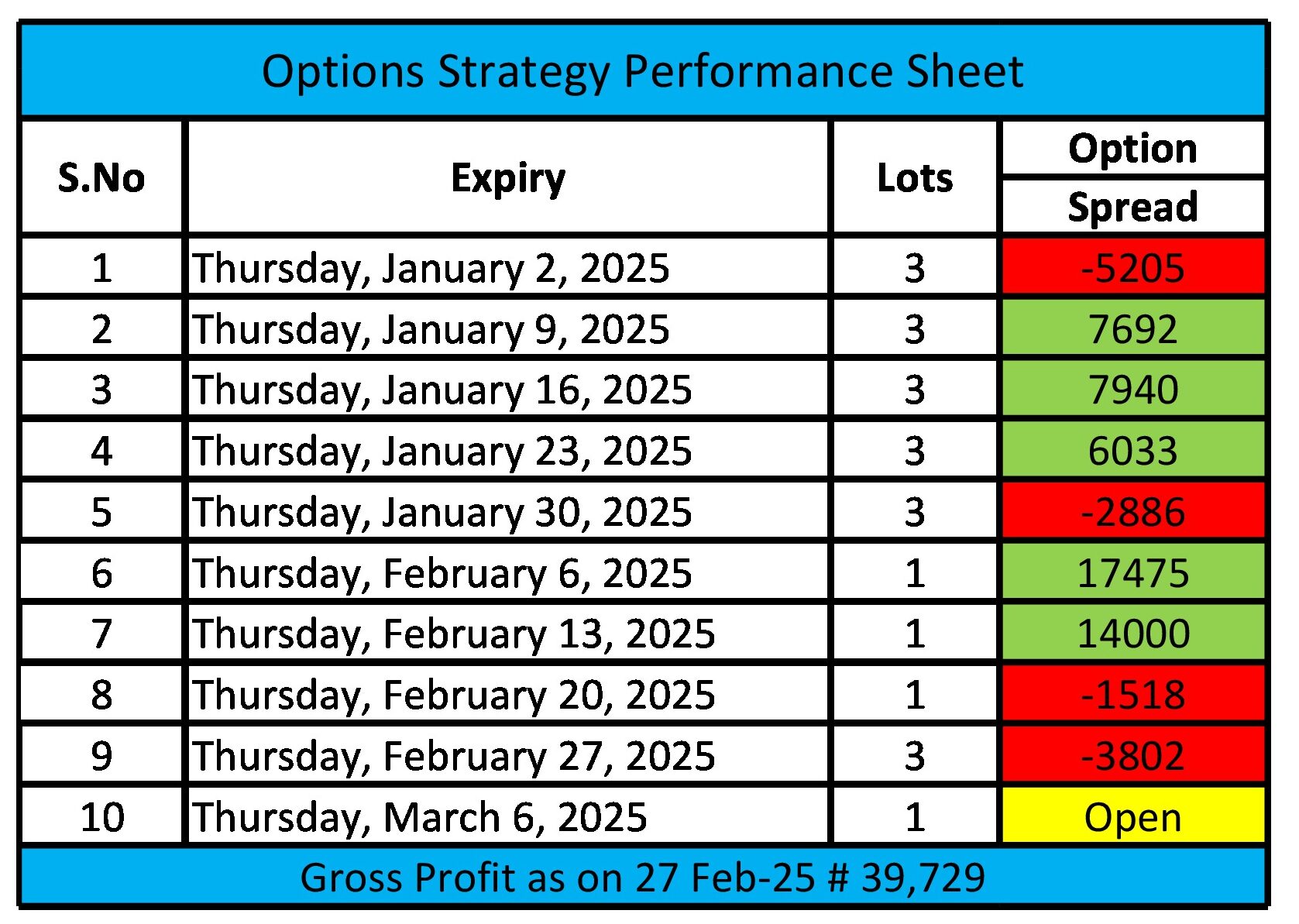

Option Trade Performance Sheet

For 9 Jan Expiry Trade details Click this Link

For 16 Jan Expiry Trade details Click this Link

For 23 Jan Expiry Trade details Click this Link

For 30 Jan Expiry Trade details Click this Link

For 06 Feb Expiry Trade details Click this Link

For 13 Feb Expiry Trade details Click this Link

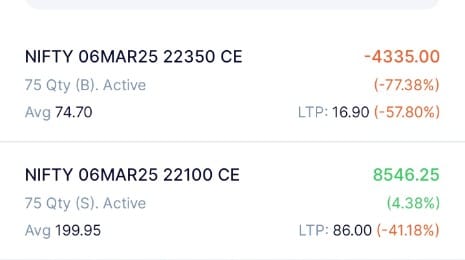

28 Feb # Today I booked Profit (7541) in Existing Trade Created new Trade in 06 March Expiry || Sold 22100 CE and bought 22350 CE for hedging purposes || Max Loss # 9500 apx || Breakeven # 22260 || For Details check the given images….

Details of Booked Profit…..

========================

Details of New Trade….

03 March # Today Nifty was quite volatile || This Position carried forward for tomorrow || On Closing basis I am having Profit of 1252

04 March # Today NIFTY closed around 22082, carried forward this Trade for next Day || On Closing basis I am having profit of 4211

05 March # Today NIFTY closed around 22334 || It was quite strong session || Booked Loss of 4312 in runing Trade || created new Trade for this Weekly Expiry || Refer Screenshot for more details

======================

06 March # On the day of Expiry Market shown a huge amount of strength and finally Trade closed in Loss (Refer Screenshot) || Booked Loss # 6232

S