Day-63 | What is intraday trading | Index trading | NIFTY | Option Trading

What is Intraday Trading

Taking position only for Intraday Trading with proper SL & Target. for intraday trading we prefer to trade in NIFTY & some Blue chip stocks with the help of Spread (Credit/Debit).To know more about intraday trading click here

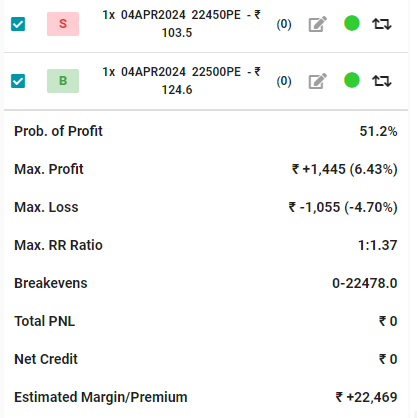

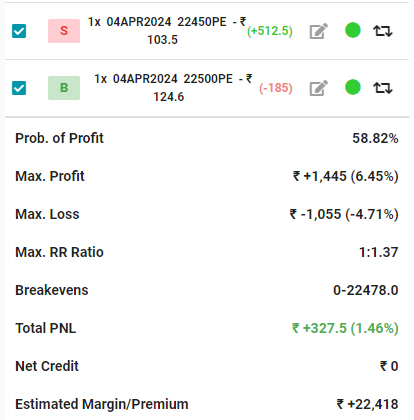

Key take away from April 01 Trade :-

- It was muted opening(within Range)

- Decided to Trade Short

- Bought 22500 PE & Sold 22450 PE, This Spread given us Profit of 327

- In the same duration 22500 PE given Profit of 512

NIFTY Pre-Market for intraday trading (April-02)

Our Intraday Strategy

02 Apr Intraday Trading Chart

Outcome of the Today’S Trade :-

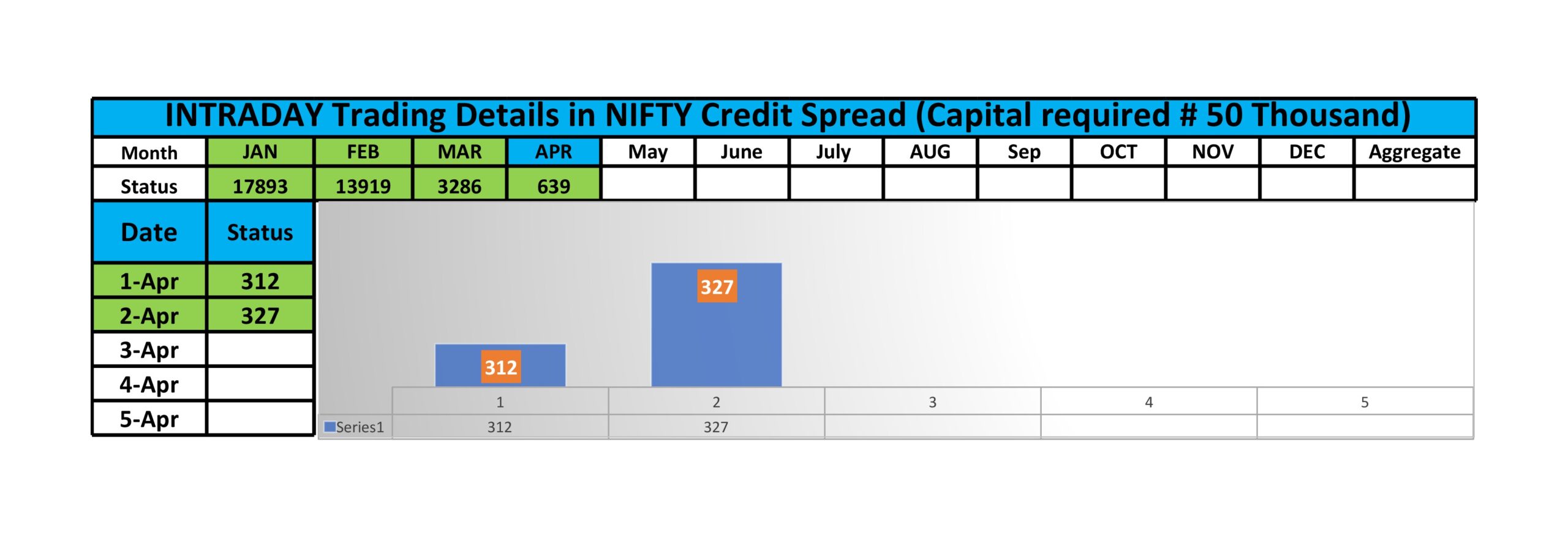

Performance Sheet

What is Credit Spread ?

If you are selling higher Delta strike(ATM/ITM) & buying lower (OTM/Deep OTM) for hedging & marging benefits.

What is Spread #

A spread is a strategy that involves taking opposite(or different) positions in same instruments (it will conists of positions that move in the opposite Direction with respect to change in market conditions.

What is NIfty or Index #

Nifty is the components of 50 top company (out of 1600 company) listed on NSE. Nifty represents or cover almost all the sectors of Economy

Option trading in NIFTY/Index with the help of Credit Spread

Now we have clear understanding of NIFTY & Credit Spread,Biggest advantage of trading Nifty with the help of options(credit spread) gives you an easy access to Risk Management System & Position Sizing Model.

Key Featues of Credits Spreads:-

1)Marging Benefis (Hardly requires 30,000 to 40,000 to create NIFTY ATM Spread),

2) Hedging benefits,(Provides security against Market volatility),

3) Quite helpful in Risk Management & Position Sizing,

4)Being a Directional Strategy gives mauch better Risk & Reward opportunity.