What is Option Greeks ?

Option Greeks are the tools which helps you to find out the right valutation of Option Contract. There are many Greeks but popular one & commonly used are :

Delta, Gamma, Theta & Vega. Lets discuss them in details :-

What is Delta?

The Delta is a measure of risk or expected move in an option price due to change in the price of underlying.

Delta will be positive in case of Call (upward movement),

Delta will be negative in case of Put (Negative movement)

If other conditions remain unchanged:

A call with near to 1 Delta (Deep ITM) will give exact move of Underlying,

A call with 0.5 Delta (ATM) will give half of the move if underlying changes,

A call near to 0 Delta (Far OTM) will give no move if any directional change notice in underlying.

Note: –

Puts have similar Charteris tics similar to call except that Put value moves in opposite direction or we can call Put options have negative delta.

An option Trader who only care about Delta & not giving importance to other factors (or Greeks) is inviting problem for himself because Delta (or underlying move) is not only the deciding factor.

In broader Sense, Delta number is nothing, it’s just a probability whether option will close in the money or not.

{For example, strike with a Delta of 25(OTM) has only 25 % probability, strike with a Delta of 75 (ITM) has 75 % chance and strike with a Delta of 50 (ATM) has 50 %

As we all know Delta is a measure of how an option value will change if underlying but always remember its just give an idea its nothing more then that especially when we see a sudden jump or correction in stock prices entire scenrio got changed

To Trade options in effective manner, one should not only consider the wining of probability of strategy but it should also be the matter of concern how much it wins or loses (in monetary term)

There is a clear relationship between DELTA and other Greeks( Gamma, Theta & Vega)https://tradingkarma.in/index.php/2024/04/05/what-is-gamma-option-greeks/

As volatility increases Delta of OTM call increase as chances of expiring increases ( which was not possible earlier) similarly Delta OF ITM decrease as conversion of ITM strike into OTM seems possible now.

When we create a Delta-neutral position evn this kind of strategy does not eliminate risk of 100% directional risk but position is typically immune to directional risk within a Range

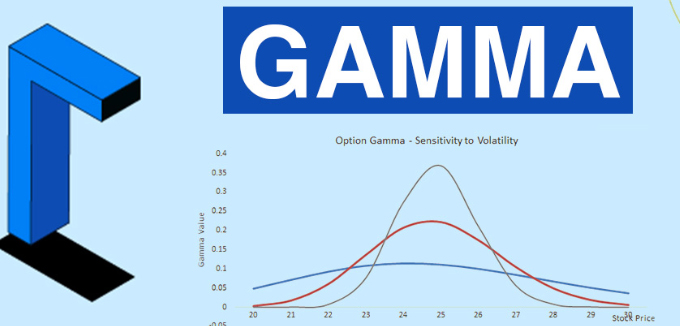

What is Gamma

Gamma Broadly can be classified as barometer which helps us in understanding that how much Delta will move due to change in underlying

Let’s understand with the help of example:

If an option has gamma of 5 for each point change in the underlying the option will change 5 points, if option has initially Delta of 25 and the underlying already move 1 full point the new delta will be 30 (25+5), in case of price correction we see reverse impact. It’s all because of Gamma we see sudden spike in Options on expiry day.

Unlike Delta, Gamma always has positive value it has nothing to do, whether its call or put, Impact of Gamma is more visible on expiry Day. In short same strike Call & Put will have same amount of Gama but it will affect their Delta in a different way

Buying Option (CE/PE) is having Long Gamma Position & Selling Options (CE/PE) is having negative gamma position.

Let’s understand relationship of DELTA & GAMMA with help of Example

Suppose a stock is Trading @ 100 & its Call option Trading @ 3.65 (with a Delta of 40 & Gamma of 2.5), If the underlying prices rises to 104 (4% increase).

Now the Delta of the option is: –

40 + 4 X 2.5 = 50

A strategy with positive Gamma have no risk of large movement in Underlying, however having Negative Gamma position is Risky.

If you have Positive Gamma Theta will be Negative or vice-versa

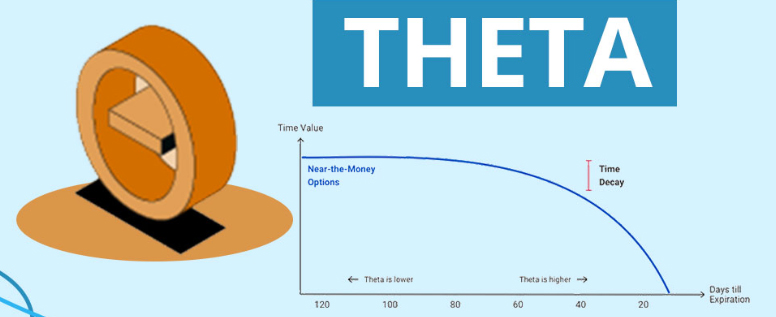

What is Theta

Option value = Intrinsic value + Time Value, as time passes Time value portion starts declining and at the day of expiry it becomes Zero and if any value is left in the option price, its nothing just an intrinsic value of the option.

The Theta or Time Decay is the rate at which Option is going to lose its value, an option with a Theta value of 0.05 will loose 0.05 value on daily basis subject to other conditions.

As Expiry comes closer Theta of Option increases. Thats why we have different Theta for same ATM strike.

There is clear relationship between Theta & Gamma, Position with positive Gamma becomes more valuable with large move especially on expiry day but on the other hand Negative THETA start giving real pain when things start moving against the Trend.

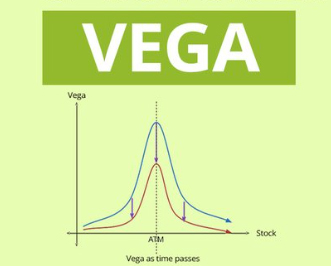

What is Vega ?

Option Prices are not only sensitive to Delta (Direction) or Theta (Time Decay) they are also affected by volatility. Vega dnotes change in option value due to change un the voaltility. Vega measures the amount of increase or decrease in an option premium based on 1% change in implied volatility.

In short Vega is a measure of how sensitive the option Premium to volatility.This is the reason why we see suudden rise in option price (both CE & PE) and VEGA is always positive in all sense.

There is Risk of taking wrong volatility as input, If use wrong input there is higher chance of having wrong distribution for the underlying contract. In such as case positive Vega will be hurt declining volatility and Negative will be hurt by rising volatility. A Trader must Consider how much volatility his Trade can afford.

I use Opstra to understand the combination & Relation of Option Greeks

What is Implied Volatility?

As we all know Equity Derivatives (Future/Options) that depends mainly or most of the time on Underlying movement but in case of Options, its value is also affected by IV (or Implied Volatility).

Implied volatility indicates the possibility of change in option price over the validity (or life) of Option, it mainly conveys the market sentiments

If stock is quite volatile IV will be higher (you can’t compare IV of Nifty to Bank Nifty),

IV is sum total of Supply, Demand, time value, uncertainty,

Usually, it’s a seen IV increase when Correction (or uncertainty) going to increase, in stable or Post event we see crash in Implied volatility

Result: –

Higher IV = Higher Option Price

Lower IV = Lower Option Price

What is VIX ?

Will be updated soon