what is the right way to trade Nifty | Option Spreads

As we all know NIFTY index is group of Top 50 stocks of Indian market shortlisted/selected on the basis of certain criteria by the exchanges, these stocks represents different section of the Economy.These Index restructure on regular basis (every 6 month),this index one of the highly tradable instrument worldwide. In this Blog we are going to discuss to NIFTY Index Trades between (8 July to 12 July) for this Trades i will use Option spreads where Risk & Reward can be defined in well advance

जैसा की हमे पता है की NIFTY Index 50 चुनिंदा Stocks का समूह है, यह स्टॉक इकॉनमी के अलग -अलग सेक्टर्स को represent करते हैएक्सचेंज एक निश्चित समय अवधी पर निफ़्टी मे शामिल स्टॉक्स की समीक्षाः करते है , निफ़्टी दुनिया भर मे सब से ज्यादा ट्रेड किये जाने वाले इंडेक्स मे शामिल है, इस ब्लॉग मे हम discuss करेंगे निफ़्टी Index के वो ट्रेड जो 8 July से 12 July के बीच होंगे, इन Trades के लिए options spreads का उपयोग होगा जहा रिस्क & रिवॉर्ड को काफी बेहतर तरीके से define किया जा सकता है

I use Opstra for creating Options spreads

Debit Spreads,Click the link for Detail (जानकारी के लिंक को क्लिक करे )

Credit Spreads,Click the link for Details(जानकारी के लिए लिंक को क्लिक करे )

July-8 NIFTY Intraday Trade Chart & Trade

Trade Summary :-

- It was range bound opening & decided to wait for retrcement (निफ़्टी एक रेंज मे खुला और लेवल retest का इंतज़ार किया )

- around 12 Nifty touched day low & near previous day started showing some sign of reversal(करीब 12 बजे निफ्टी ने दिन का निचला स्तर छुआ और पिछले दिन के के लोअर लेवल के करीब था ),

- around 12.30 created Debit spread (लगभग 12.30 बजे डेबिट स्प्रेड बनाया गया),

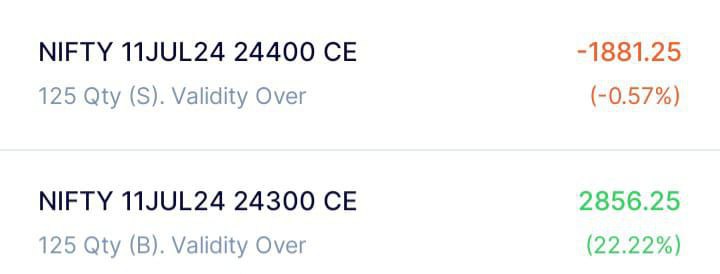

- Bought 24300 CE & Sold 24400 CE for hedging ( 24300 CE खरीदा और 24400 CE बेचा,

- QuantityTraded 5 Lot / 5 लॉट का कारोबार हुआ

- Debit Spread Calculation (डेबिट स्प्रेड )

- Credit Spread Calculation (क्रेडिट स्प्रेड )

July-9 NIFTY Intraday Trade Chart & Trade

Trade Summary :-

- It was strong opening,(यह एक मजबूत शुरुआत थी,)

- I had decided to short NIFTY at appropriate point but taken a compulsive Trade around 9.45 as risk reward was quite good it compelled me to take this decision,(मैंने उचित समय पर NIFTY को शॉर्ट करने का निर्णय लिया था, लेकिन 9.45 के आसपास एक compulsive ट्रेड लिया, Risk & Reward काफी अच्छा था, जिसने मुझे यह निर्णय लेने के लिए बाध्य किया।

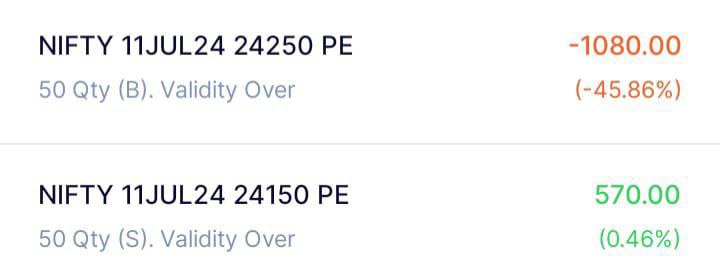

- Bought 24250 PE & Sold 24150 PE for hedging purpose,(24250 पीई खरीदा और 24150 पीई बेचा,)

- Qty Traded # 2 Lot, (कारोबार की मात्रा # 2 लॉट)

- This Trade given a Loss of 510 (इस ट्रेड में 510 का घाटा हुआ)

- Debit Spread Calculation (डेबिट स्प्रेड )

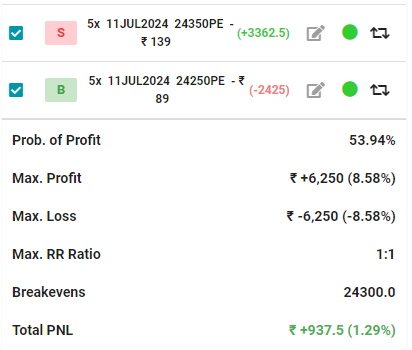

- Credit Spread Calculation (क्रेडिट स्प्रेड )

July-10 NIFTY Intraday Trade Chart & Trade

Trade Summary :-

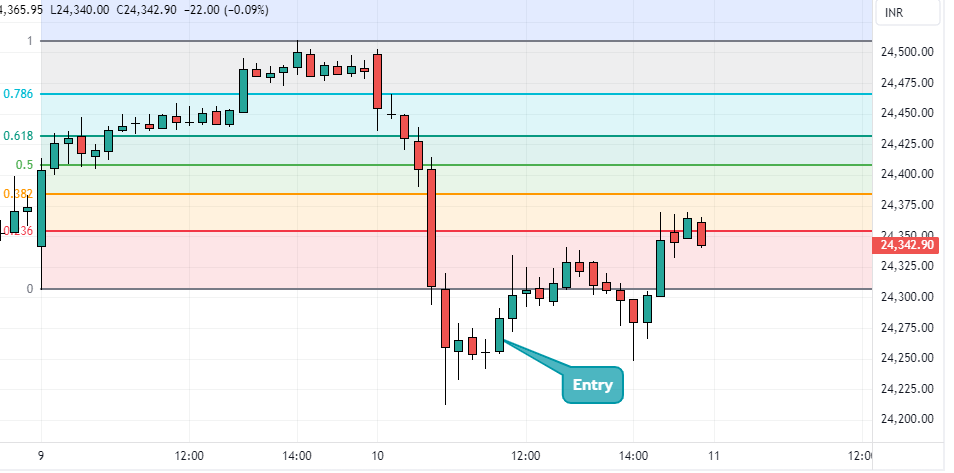

- It was opening within previous day range then market start falling like anything, decided to wait for reversal

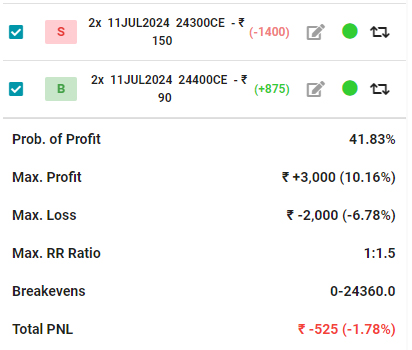

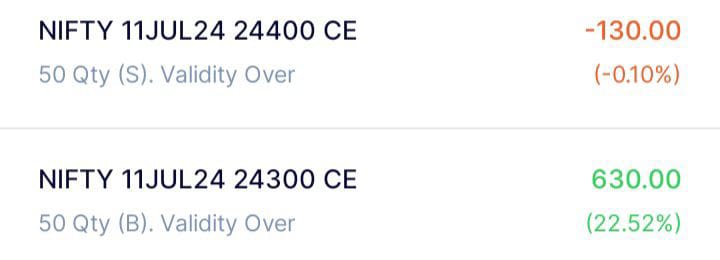

- Around 11.45 I made a long position in NIFTY, Bought 24300 CE & sold 24400 CE

- Qty. Traded # 2 Lot

- This Trade given a Profit of 500

- Debit Spread Calculation (डेबिट स्प्रेड )

- Credit Spread Calculation (क्रेडिट स्प्रेड )

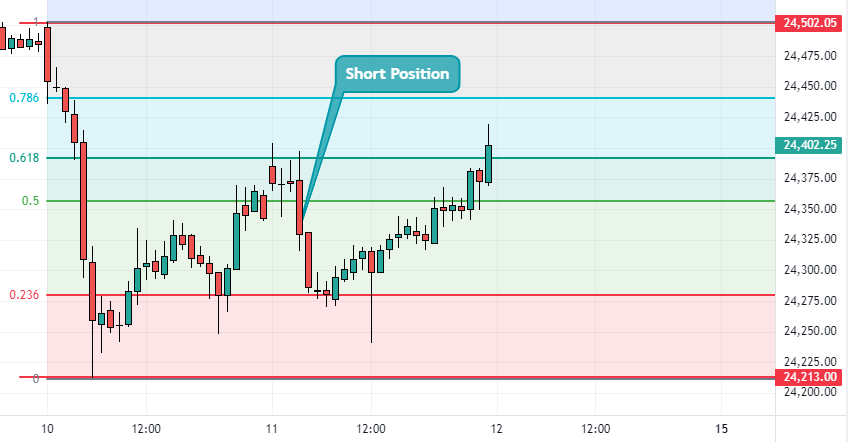

July-11 NIFTY Intraday Trade Chart & Trade

Trade Summary :-

- It was Gap up opening but within previous Day Range, Decided to short at the right moment

- Taken Short Positin in Nifty around 10.15

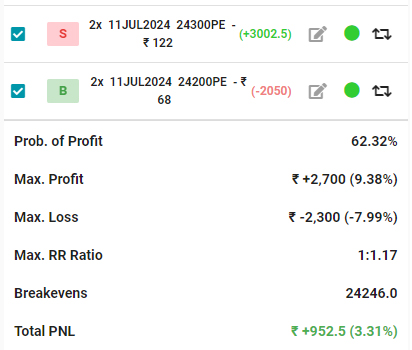

- Bought 24200 PE & Sold 24300 PE for hedging purpose

- Nifty went in our direction for next one hour from previous day Low(near fibo level) it taken reversal

- This Trade given loss of 1800

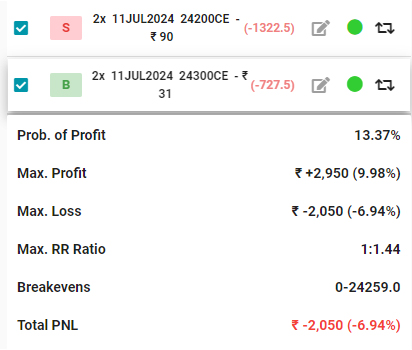

- Debit Spread :-

- Credit Spread

July-12 NIFTY Intraday Trade Chart & Trade

Trade Summary :-

- It was positive opening and as a reversal Trader decided to short

- Taken short position around 9.45

- Bought 24300 PE & Sold 24200 PE

- Nifty taken support near Fibo level then taken reversal from there

- This Trade given loss of 412

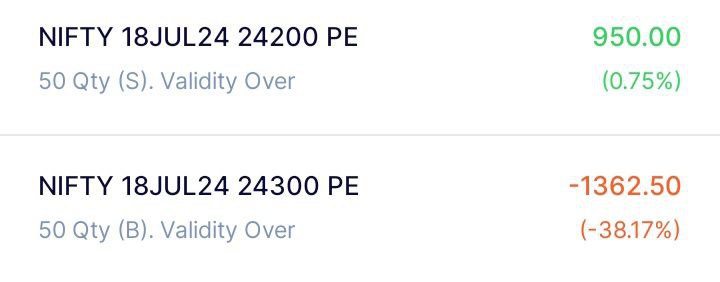

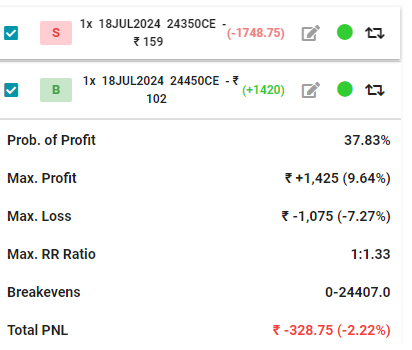

- Debit Spread Details :-

- Credit Spread Details :-

========================

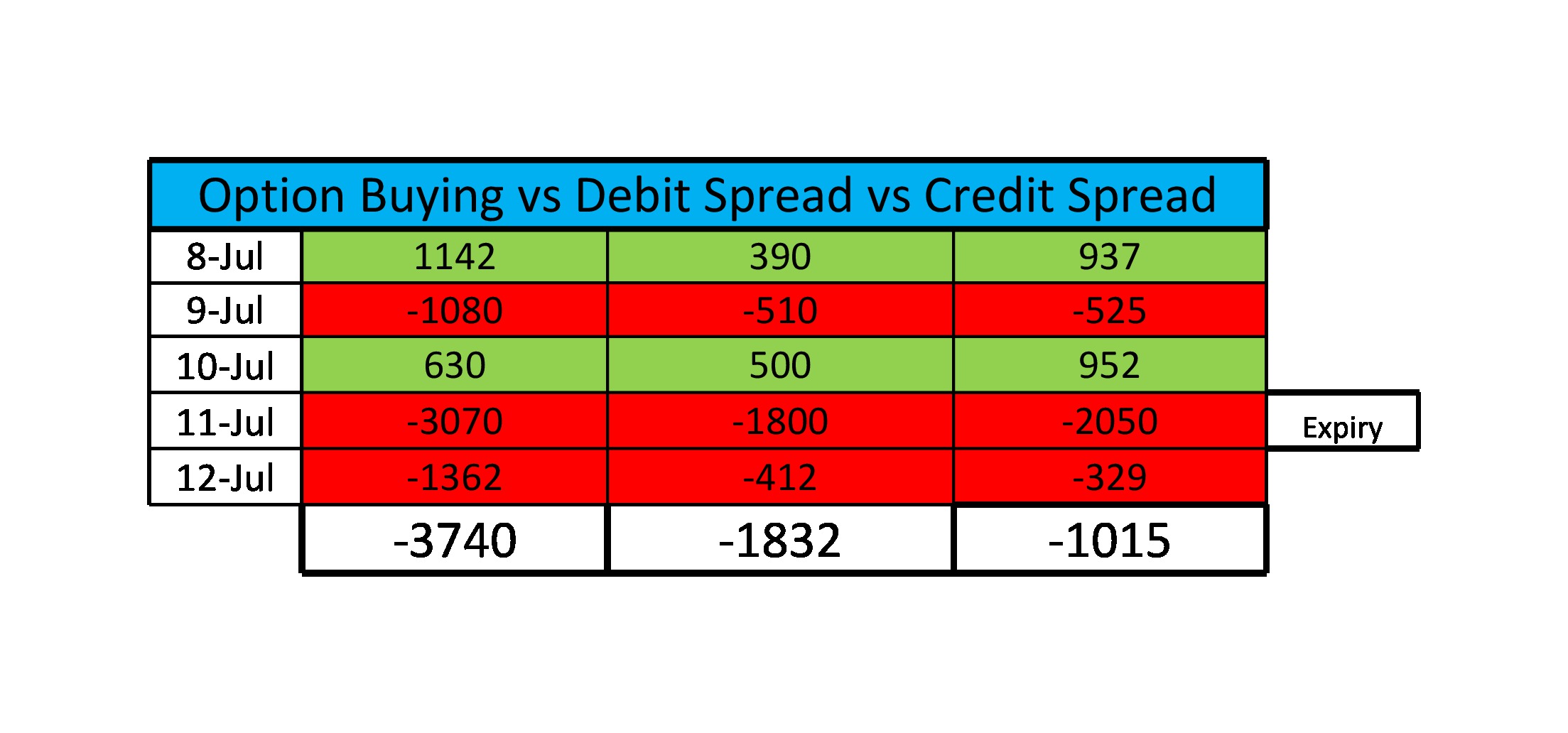

Comparison of Naked Option vs Debit Spread vs Credit Spread