how to trade Nifty weekly Expiry | 29 Aug Expiry Trade

Expiry Trading is quite popular these Days. Nifty weekly Expiry is held on every weekly Thursady. Being Directional Trader I try to predict move (Bullish/Bearish) for next few days(till weekly expiry). most of the time I use Credit Spread for trading NIFTY weekly Expiry. For 29 August Expiry I am expecting 300(+) point move in the NIFTY on the Long side. Lets understand this concept with the help of Chart and option Strategy (using Opstra)

NIFTY Future Chart (75 Min)

23 Aug (Day-1) # Nifty was range bound throughout the Day, no clear direction ( after Positive update from US we might see Gap up opening on Monday but real strength will come only if NIFTY started Trading above 24867

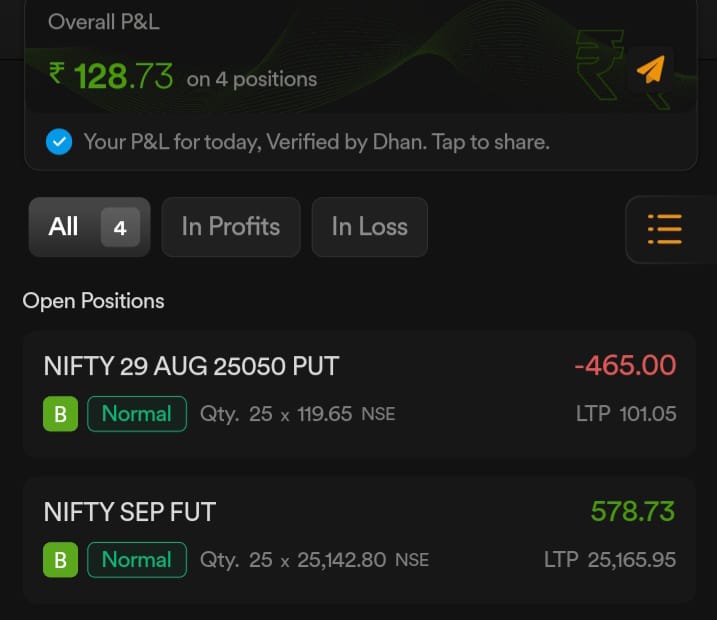

26 Aug (Day-2) # As per expected line NIFTY opened gap up around 11.30 made a long position in NIFTY(Refer Screenshot)

27 Aug (Day-3) # Today Nifty touched high of 25070 but closed below 25000, on a daily chart it made a Dozi

28 Aug (Day-3) # Today on a daily chart Nifty made a spinning Top with a high of 25130 and a low of 24964, Tommorrow is monthly expiry and some big result will be announced today in US Market just like Yesterday Today we closed with a loss of 500 apx just like yesterday

29 Aug (Day-4) # on the day of monthly expiry market was huge volatile we have seen high of 25193 and Low of 24998, on closing basis NIFTY Sept Fut. Closed near 25270 ( given Profit of 3175) and 25050 Put given Loss of 3000

Conclusion # NIFTY given limited move of 120 Points ultimately This Trade given NO PROFIT NO LOSS