swing Trade | LT

SWING TRADE involves taking position in a financial instrument for more than day (and less than a month), Target & Risk can be predefined with the help of option strategy || SWING TRADE का मतलब है एक दिन से अधिक (और एक महीने से कम) के लिए Trade लेना, Predefirned Target (और Stop Loss ) भी इस ट्रेडिंग फॉर्मेट का एक फीचर है

For Charting I use Trading view

For Free Stock Market Course, click this Link

Lets understand concept of swing Trade with the help of real time example ( LT Trade)

I am having bullish view on LT, on 31 OCT I have created Long position in LT and bought 137 Qty. @ 3640 (investment in this Trade is around 5 Lakh,used MTF ( 125000 X 3) for creating this position). Lot Size of LT is 150 || मैं LT पर तेजी का नजरिया रख रहा हूं, 31 OCT को मैंने LT में लॉन्ग पोजीशन बनाई और 3640 पर 137 qty. खरीदी (इस ट्रेड में निवेश करीब 5 लाख है, इस पोजीशन को बनाने के लिए MTF (125000 X 3) का इस्तेमाल किया)। LT का लॉट साइज 150 है।

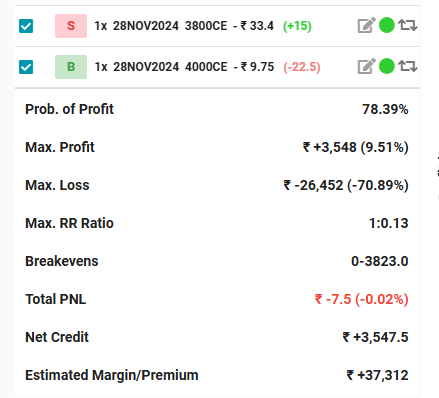

I am going to use Option strategy ( Credit Spread) as I am already having Long position in LT Equity, I will sell far OTM and hedge this position ( Refer under given Table)

On 25 Nov having a Profit of 8220 in Equity Trade and having a Profit of 3400 in Credit Spread