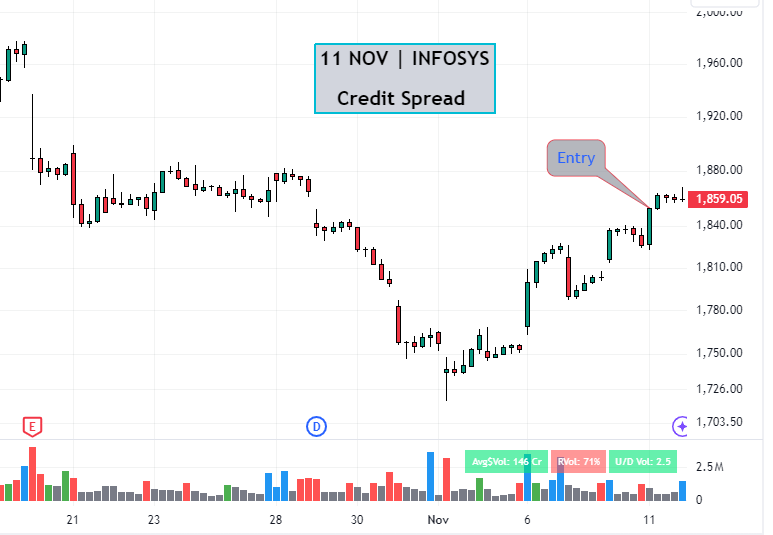

Credit Spread | Infosys Trade

Credit Spread implies when you are selling higher Delta strike (ATM/ITM) & buying lower (OTM/Deep OTM) for hedging & margin benefits. A spread is a strategy that involves taking opposing positions in different but related instruments (it will conists of positions that move in the opposite Direction with respect to change in market conditions,one strike trade will be profitable & other will be loss making)

क्रेडिट स्प्रेड का मतलब है कि जब आप हेजिंग और मार्जिन लाभ के लिए उच्च डेल्टा स्ट्राइक (एटीएम/आईटीएम) बेच रहे हैं और कम (ओटीएम/डीप ओटीएम) खरीद रहे हैं। स्प्रेड एक ऐसी रणनीति है जिसमें अलग-अलग लेकिन same stock में विपरीत स्थिति लेना शामिल है (इसमें ऐसी स्थितियाँ शामिल होंगी जो बाजार की स्थितियों में बदलाव के संबंध में विपरीत दिशा में चलती हैं, एक स्ट्राइक ट्रेड लाभदायक होगा और दूसरा घाटे में चल रहा होगा)

I share my chart analysis on Front Page

For Sock Market Learning, click this Link

Lets understand the Concept with the help of an example. || आइये एक उदाहरण की मदद से इस अवधारणा को समझते हैं।

I have created Long position in Infosys on 11 Nov 2024 when stock was trading around 1850, invested 5 Lakh rupee in this Trade and bought 270 qty. || मैंने 11 नवंबर 2024 को इंफोसिस में लॉन्ग पोजीशन बनाई है, जब स्टॉक 1850 के आसपास कारोबार कर रहा था, इस ट्रेड में 5 लाख रुपये का निवेश किया और मार्जिन ट्रेडिंग फंडिंग (125000 X 4) की मदद से 270 शेयर खरीदे।

I have created Created option Spread to hedge my position in Equity || मैंने इक्विटी में अपनी स्थिति को सुरक्षित रखने के लिए Options स्प्रेड बनाया है…

12 NOV # Today Stock Closed around 1861, Profit in Equity Trade=2970 and Loss in Credit Spread=3640

13 NOV # Today Stock Closed around 1870, Profit in Equity Trade=5400 and Loss in Credit Spread=1180

14 NOV # Today Stock Closed around 1865, Profit in Equity Trade=4050 and Loss in Credit Spread=940

18 NOV # Today Stock Closed around 1810, Loss in Equity Trade=10800 and Profit in Credit Spread=8500

19 NOV # Today Stock Closed around 1825, Loss in Equity Trade=6750 and Profit in Credit Spread=6560

21 NOV # Today Stock Cloased around 1834, Loss in Equity Trade=4320 and Profit in Credit Spread=4960

22 NOV # Today Stock Cloased around 1902, Profit in Equity Trade=14040 and Loss in Credit Spread=6480

25 NOV # Today Stock Cloased around 1890, Profit in Equity Trade=10800 and Loss in Credit Spread=6880

26 NOV # Today Stock Cloased around 1924, Profit in Equity Trade=19980 and Loss in Credit Spread=8000