Demand Zone & Supply Zone | 26 September 2024…

Demand Zone & Supply Zone stands for the area where we see large activitiy (Buying or Selling). As we know Institutions or Big Players prefers to make their positions at their predecided Price (Level or Price Zone) this activity ultimately results into Demand Zone & Supply Zone

In this Blog I try to summarise Demand & Supply Zone for NIFTY Top 10 stocks, Crude Mini & NIFTY, this level can be used for Intraday & ( for Swing Trade also subject to the fullfilment of some conditions.) Check the Below given Table

Trade Summary (1 Hit & 2 Miss)

1) Axis Bank (Lot Size-625) # There was No Trading opportunity,

2) Bharti Airtel(Lot Size-475) # There was No Trading opportunity,

3)Crude Mini Contract (Lot Size-10) # Demand Zone Broken then serious correction started

4)HDFC Bank (Lot Size-550) # There was No Trading opportunity,

5)ICICI Bank (Lot Size-700) # There was No Trading opportunity,

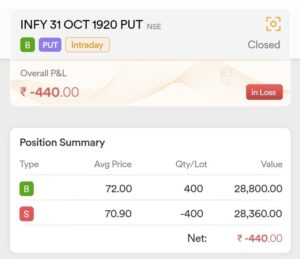

6)Infosys (Lot Size-400 )#Check Screeshot for details

7)ITC (Lot Size-1600) # There was No Trading opportunity,

8)L&T (Lot Size-150) #There was No Trading opportunity,

9)NIFTY(Lot Size-25) #There was No Trading opportunity,

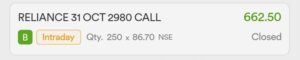

10)Reliance (Lot size-250)# Check Screeshot for details

11)SBI (Lot Siz-750) # Trailing SL hit

12)TCS (Lot size-175) # There was No Trading opportunity,