Demand Zone & Supply Zone | 27 Sept

Demand Zone & Supply Zone stands for the area where we see large activitiy (Buying or Selling). As we know Institutions or Big Players prefers to make their positions at their predecided Price (Level or Price Zone) this activity ultimately results into Demand Zone & Supply Zone

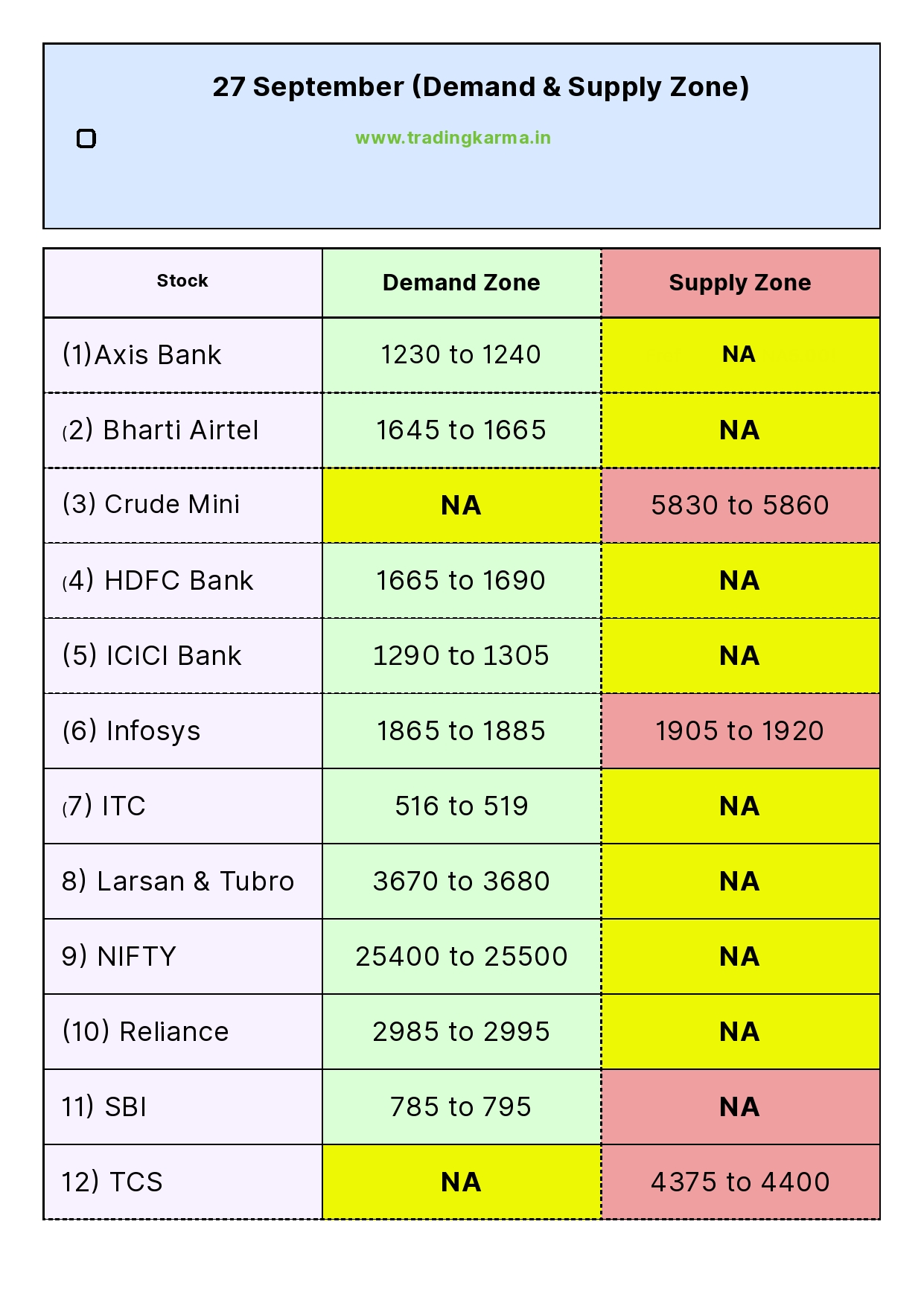

In this Blog I try to summarise Demand & Supply Zone for NIFTY Top 10 stocks, Crude Mini & NIFTY, this level can be used for Intraday & ( for Swing Trade also subject to the fullfilment of some conditions.) Check the Below given Table. If in Live Market Price Action Support this Zone I will create position

डिमांड जोन & सप्लाई जोन से अभिप्राय उस Price जोन जहा Institutional एक्टिविटीज (बाइंग और सेल्लिंग के चांस ) सबसे ज्यादा होता है, जैसे की हमें पता है की बाजार के बड़े प्लेयर जैसे म्यूच्यूअल फंड्स आदि अपने निश्चित प्राइस रेंज मे ही खरीदारी पसंद खरीदते है इस वजह से Demand जोन और Supply जोन की Importance और बढ़ जाती है

इस ब्लॉग मे मैंने निफ़्टी के Top 10 Stocks, Crude Mini Contract और निफ़्टी के Demand Zone और सप्लाई जोन को समझने की कोशिश की है, अगर बाजार लाइव मार्किट मे Price Action इसको सपोर्ट करेगा तो मे ट्रेड लूंगा

Demand & Supply Zone Table

Trade Summary ( Hit # 3 & Miss 1)

Trade Summary ( Hit # 3 & Miss 1)

1) Axis Bank (Lot Size-625) # There was No Trading opportunity,

2) Bharti Airtel(Lot Size-475) # There was No Trading opportunity,

3)Crude Mini Contract (Lot Size-10) # There was No Trading opportunity,

4)HDFC Bank (Lot Size-550) # There was No Trading opportunity,

5)ICICI Bank (Lot Size-700) # There was No Trading opportunity,

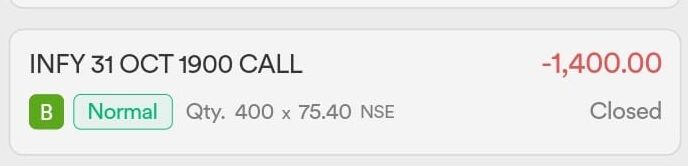

6)Infosys (Lot Size-400 )# Check Trade Details

7)ITC (Lot Size-1600) # There was No Trading opportunity,

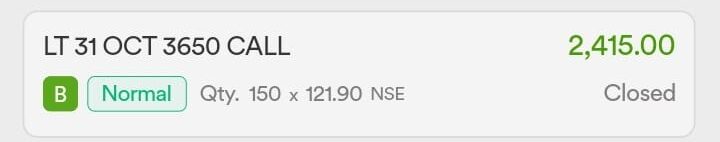

8)L&T (Lot Size-150) #Check Trade Details

9)NIFTY(Lot Size-25) #There was No Trading opportunity,

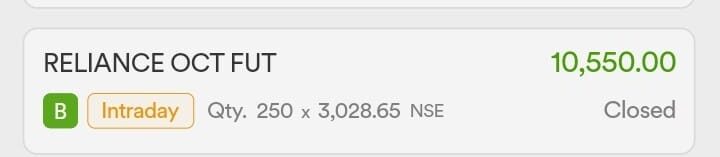

10)Reliance (Lot size-250)# Check Trade Details

11)SBI (Lot Siz-750) # There was No Trading opportunity,

12)TCS (Lot size-175) # Small Miscalculation in Trailing SL results into smaller Profit, Check Trade Details