Nifty option hedging strategy with example || 27 Mar NIFTY Weekly Expiry

Hedging in Nifty (using different NIFTY Option hedging strategies) is essential for reducing risk, especially in volatile markets. you can create position in NIFTY against your Long terma holding or Positional Trades ( as I do),sharing some effective Nifty Option Hedging Strategies :-

1. Protective Put # (For Long Positions) # Buying Put

2. Covered Call # (For Neutral to Slightly Bullish View) # Selling OTM Call

3. Iron Condor # (For Range-Bound Markets) # Selling ATM (CE & PE) and buying OTM CE and PE

4. Straddle & Strangle # (For High Volatility) Buy CE & PE || (For Low Volatility = Sell CE & PE

6. Collar Strategy (For Safe Hedging)# Buy stock fut (or equal qty of stocks) and buy put or sell call against it

Performance Sheet

Click the under given Link for previous week NIFTY weekly Expiry Trades created for hedging purposes

For 9 Jan Expiry Trade details Click this Link

For 16 Jan Expiry Trade details Click this Link

For 23 Jan Expiry Trade details Click this Link

For 30 Jan Expiry Trade details Click this Link

For 06 Feb Expiry Trade details Click this Link

For 13 Feb Expiry Trade details Click this Link

For 20 Feb Expiry Trade details Click this Link

For 27 Feb Expiry Trade details Click this Link

For 06 Mar Expiry Trade details Click this Link

Usually I prefer to create short position in NIFTY against my holding (on Thursday) but today I avoided will prefer to wait for some sign of weakness || Having Long position in HDFC Bank and Reliance

Day-1# No Trading opportunity on the short side in NIFTY……

Day-2# No Trading opportunity on the short side in NIFTY…..

Day-3# No Trading opportunity on the short side in NIFTY…..|| I will prefer to short NIFTY if it strat trading below 23650, otherwise no Shorting oppotunity

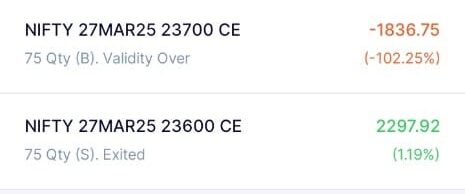

Day-4# Today made a short position in NIFTY as decided once it started Trading below 23650, though position made bit late, for Trade details refer screenshot

Day-5# Today Market opened gap down || Today I squared off my position with minor profit of 461