what is credit spread | NIFTY | Index Trading

What is Credit Spread ?

If you are selling higher Delta strike(ATM/ITM) & buying lower (OTM/Deep OTM) for hedging & marging benefits.

What is Spread # A spread is a strategy that involves taking opposing positions in different but related instruments(it will conists of positions that move in the opposite Direction with respect to change in market conditions,one strike trade will be profitable & other will be loss making)

Key Fetaures of Credit Spread Strategy :-

A) Focus primarily on the direction of the underlying,direction is primary & volatilty characteristics is of secondary importance

B) One option is purchased & one option is sold ( option should be of same type or same expiry

C) Trader can increase or decrease its marging of profit just by selecting the gap of strikes (more the gap,more will be & more will be reward)

D) if implied volatility is high then its a time to sell ITM and buy ATM and vice versa

What is NIfty or Index # An index is a number that represents the composite value of Group, in case of Stock Index , the value of the Index is determined by the market prices of the stocks. Nifty is the components of 50 top company (out of 1600 company) listed on NSE. Nifty represents or cover almost all the sectors of Economy

Option trading in NIFTY/Index with the help of Credit Spread

Now we have clear understanding about NIFTY & Credit Spread, lets get into the details how the combination of these two works in Real Market Conditions.

Biggest advantage of trading INDEX (or Nifty) with the help of options(credit spread) gives you an easy access to Risk Management System & Position Sizing Model.

Key Featues of Credits Spreads

1)Marging Benefis (Hardly requires 30,000 to 40,000 to create NIFTY ATM Spread),

2) Hedging benefits,(Provides security against Market volatility),

3) Quite helpful in Risk Management & Position Sizing,

4)Being a Directional Strategy gives mauch better Risk & Reward opportunity.

5) Please go through the real Trade examples( Last 6 Trading sessions of January).

Gross Profit as on date(6 trades) # 9084

-============================================

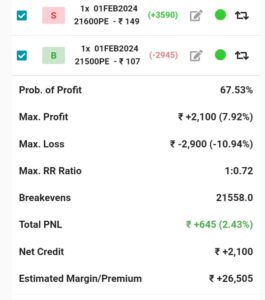

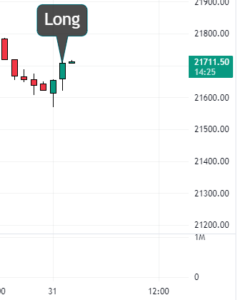

6) 31 Jan NIFTY Intraday Trade (645 Profit Per Lot)

===============================================

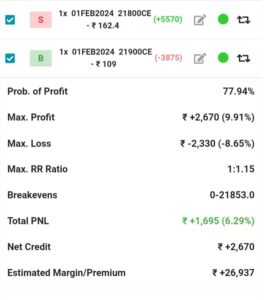

5) 30 Jan NIFTY Intraday Trade (1695 Profit Per Lot)

====================================

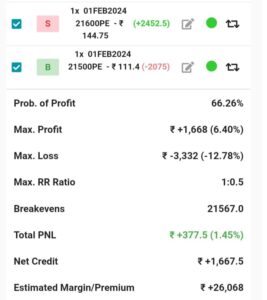

4) 29 Jan NIFTY Intraday Trade (377 Profit Per Lot)

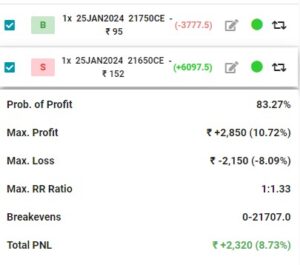

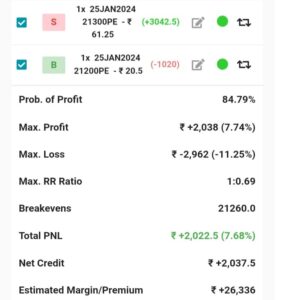

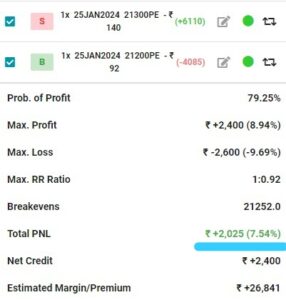

3) 25 Jan NIFTY Intraday Trade (2022Profit Per Lot)

==========================================================

2) 24 Jan NIFTY Intraday Trade (2025 Profit Per Lot)

==========================================================

1) 23 Jan NIFTY Intraday Trade (2320 Profit Per Lot)