is option buying good || Option Buying Performance Sheet || Jan Expiry

Options are generally risky, but some options strategies can be relatively low risk and can even enhance your returns as a stock investor. Like stockholders, owners of options can enjoy the potential upside if a stock is acquired at a premium to its value, though they’ll have to own the options at the right time

Profit from Option Buying # 54644

Profit from Directional Option strategy # 4954

Profit from Non-Directional Option Strategy # 58161

Bhart Airtel Trade Discussion

I entered in Bhart Airtel Short Position on 06 Jan (11.45), bought 1580 Put and Exit from this Trade next day

I entered in Bharti Airtel Long Trade on 09 Jan (1.00), and Exit from this position Jan-24 due to expiry factor, still having bullish view on Bharti and created long position in Feb Expiry

Result of Directional Option Strategy :-

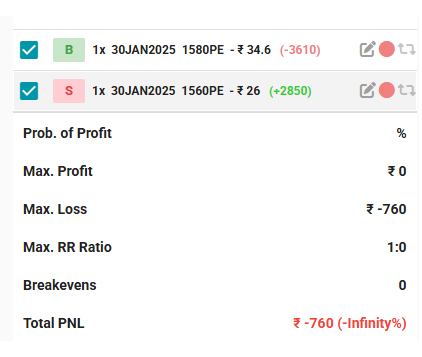

Bear Spread

================

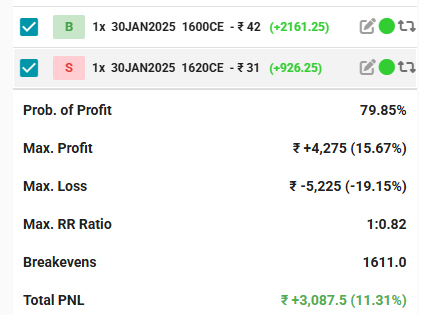

Bull Spread

Result of Non-Directional Option strategy (Straddle + Option Buying),

Short Trade

Long Trade (Details available on this Blog, click this Link)

Result Summary (In Bharti Airtel 2 Trades during Jan Expiry) :-

Option buying # (3610-2161) = Loss of 1461

Directional Option Strategy # (3087-760) = Profit of 2327

Non Directional Option Strategy # (309 + 9310) = Profit of 9619

HDFC Bank Trade Discussion

I entered in HDFC Bank Short Trade on 31 Dec (2.15) and Exit from this Trade on 20 Jan (11.45), stock is looking stable, created no further position in Feb Expiry

Result of Directional Option Strategy :-

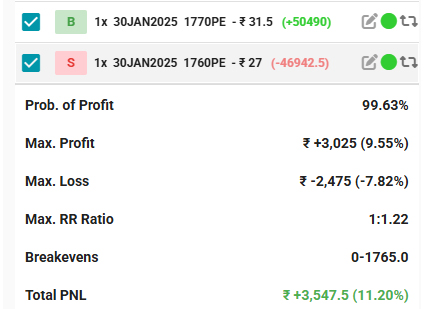

Debit Spread (or Bear Spread)

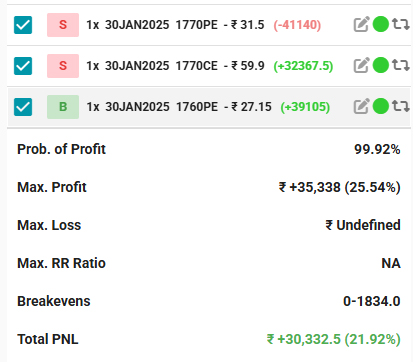

Result of Non-Directional Option strategy (Straddle + Option Buying)

Short Trade

Result Summary (In HDFC Bank Trade during Jan Expiry) :-

Option buying # = Profit of 50490

Directional Option Strategy = Profit of 3547

Non Directional Option Strategy = Profit of 30332

ICICI Bank Trade Discussion

Result of Directional Option Strategy :-

I created short position in ICICI Bank 3 Jan (10.30) and made a exit on 24 Jan, created short position in Feb Expiry

Result of Directional Option Strategy :-

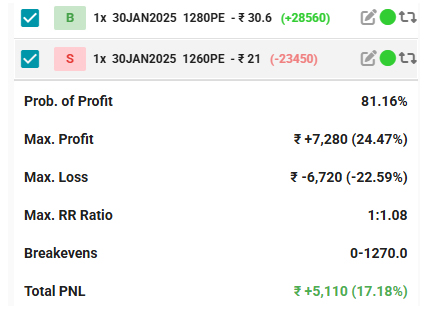

Debit Spread (or Bear Spread)

Result of Non-Directional Option strategy (Straddle + Option Buying)

Short Trade

Result Summary (In ICICI Bank Trade during Jan Expiry) :-

Option buying # = Profit of 28,560

Directional Option Strategy = Profit of 5,110

Non Directional Option Strategy = Profit of 15,295

===============

Infosys Trade Discussion

I created Short position in INFY on 31 Dec (10.30) and exit on 24 Dec due to expiry facto and created Fresh short position in Feb Expiry

Result of Directional Option Strategy :-

Debit Spread (or Bear Spread)

========================

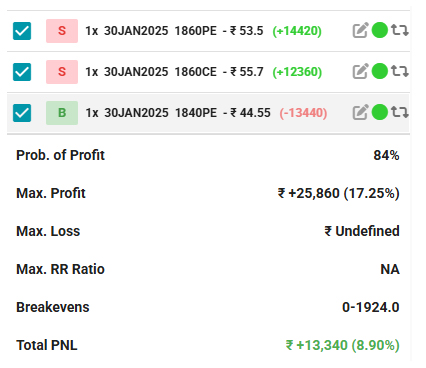

Result of Non-Directional Option strategy (Straddle + Option Buying)

Short Trade

Result Summary (In Infosys Trade during Jan Expiry) :-

Option buying # = Loss of 16920

Directional Option Strategy = Loss of 1760

Non Directional Option Strategy = Profit of 13,340

================================

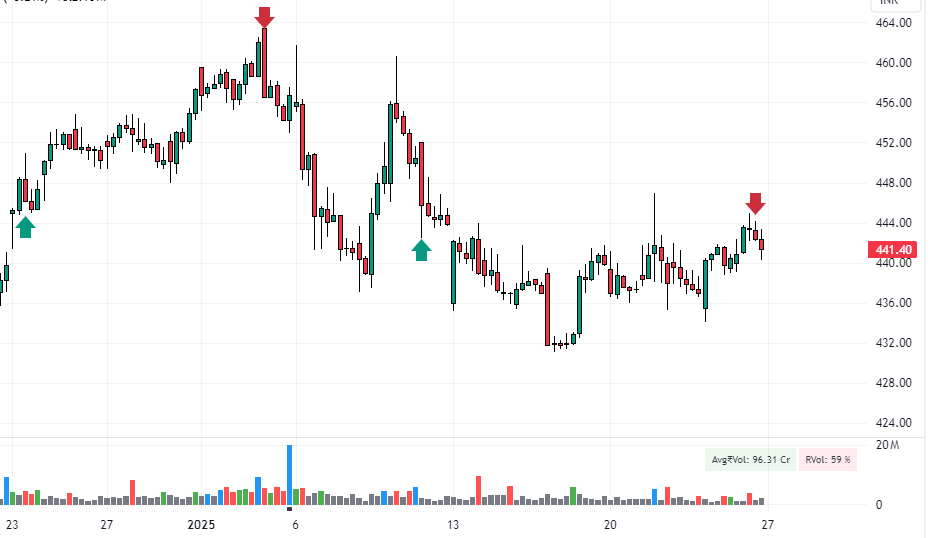

ITC Trade Discussion

I have created Long Position in ITC on 23 Dec (11.45) and exit from position on Jan-03 (10.30) and Created Short position on Jan-10 (10.30) and exit on Jan-24, created short position in Feb Expiry

Result of Directional Option Strategy :-

Debit Spread (or Bull Spread)

================

Debit Spread (or Bear Spread)

Result of Non-Directional Option strategy (Straddle + Option Buying)

Long Trade

Short Trade

Result Summary (In ITC Trade during Jan Expiry) :-

Option buying # = (7040-2240) # Profit of 4800

Directional Option Strategy = (1040-960) # Profit of 80

Non Directional Option Strategy = Profit of 4000

Reliance Trade Discussion

On 17 Jan (1.00) entered in the Long Trade of Reliance exit from the position due to Expiry Factor and created Long position in Feb Expiry

Result of Directional Option Strategy :-

Debit Spread (or Bull Spread)

Result of Non-Directional Option strategy (Straddle + Option Buying)

Long Trade