Positional Trade Report | Jan-01 to Aug-31

In Positional Trading few fundamentally good stocks are shortlised and positions are made in them on the basis of Technical Analysis

In My model I do Positional Trading in Top 10 NIFTY company with fixed target & I am ready to adjustment like (averaging or call writing etc ) as per the condition,Holding period can be one day,one week or few months.

I never keep more then 6 open position at a time & never invest more then 1/6 th in a single Trade while averaging I cross this limit but never do averaging more then 2 times in any stock. This Model given 40 to 100 (%) return in last 20 months depending upon the usage of Margin Trading Facility and Trading activity

For previous year Performance sheet click this Link

Basic Structure of my model:-

A) CapitalRequired 1,00,000 (or above)

B) Divide this Capital into two parts

C) Use 75,000 for Positional Trading in NIFTY Top 10 Stocks

D) Use 25,000 for Derrivative Trading

E) Use MTF for higher return in Positional Trading

F) Use any Risk defined strategy for Derrivative Trading

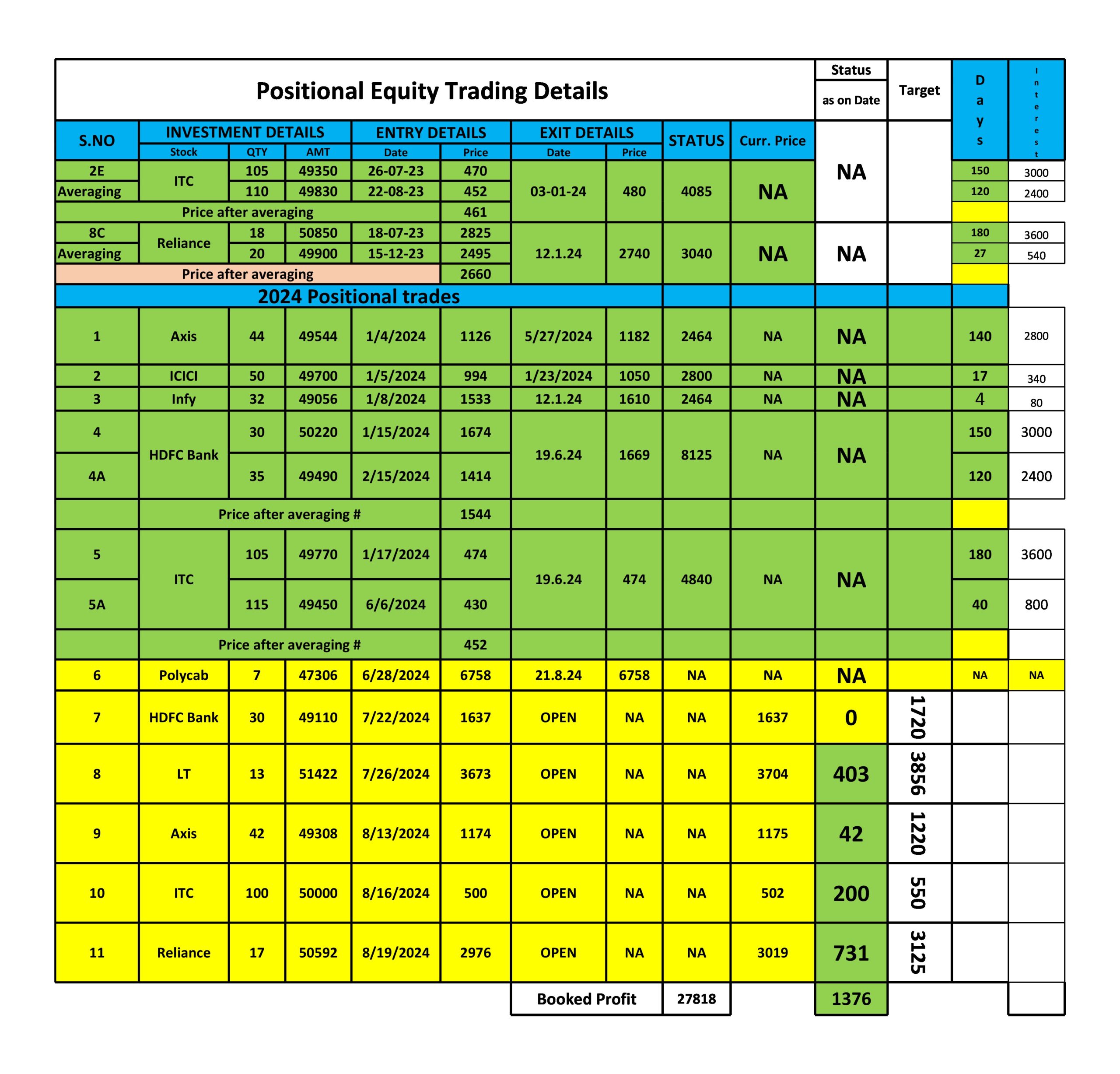

- Please Check the Below given Performance Sheet for Positional Trades…

===============

Right now I am having open Position in HDFC Bank , L&T, Axis Bank, ITC & Reliance

Booked Profit between Jan-1(2023) to 31 Dec-(2023) #76379

Booked Profit between Jan-1(2024) to 31Aug-(2024) # 27818

Unrealised Profit in Open Position # 1376

Positional Trade Performance Sheet

What is MTF or Margin Trading Facility?

What is MTF or Margin Trading Facility?

When you use certain amount of yours and raise remaining part from Broker this facility of Fund arrangement is known as MTF and Broker charge interest on the sanctioned amount (interest rate is usually between 9 to 15 %) it all depends upon your Broker and the Plan you are having.

Last but not least never forget leverage is a double edge sword if you don’t how to use it then its very dangerous and you can’t expect same amount of MTF on different stocks, it keeps on changing as you change the category of Stock