NIFTY Analysis

07 Jan | Swing Trade | Debit Spread | Infosys

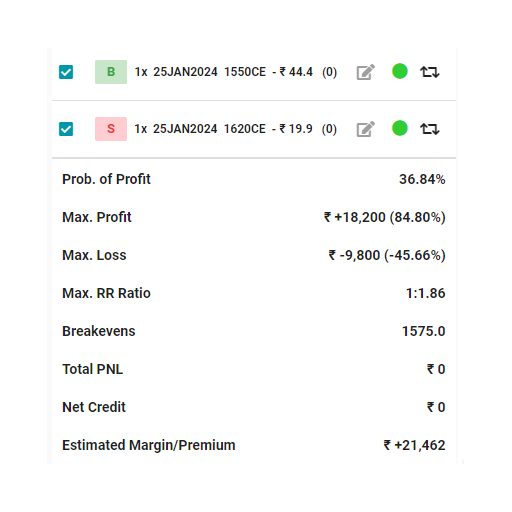

Debit Spread

Debit spread popularly known as Bull Spread or Call Spread or Vertical spread

Bull spread strategy –

A) Focus primarily on the direction of the underlying,direction is primary & volatilty characteristics is of secondary importance

B) One option is purchased & one option is sold ( option should be of same type or same expiry

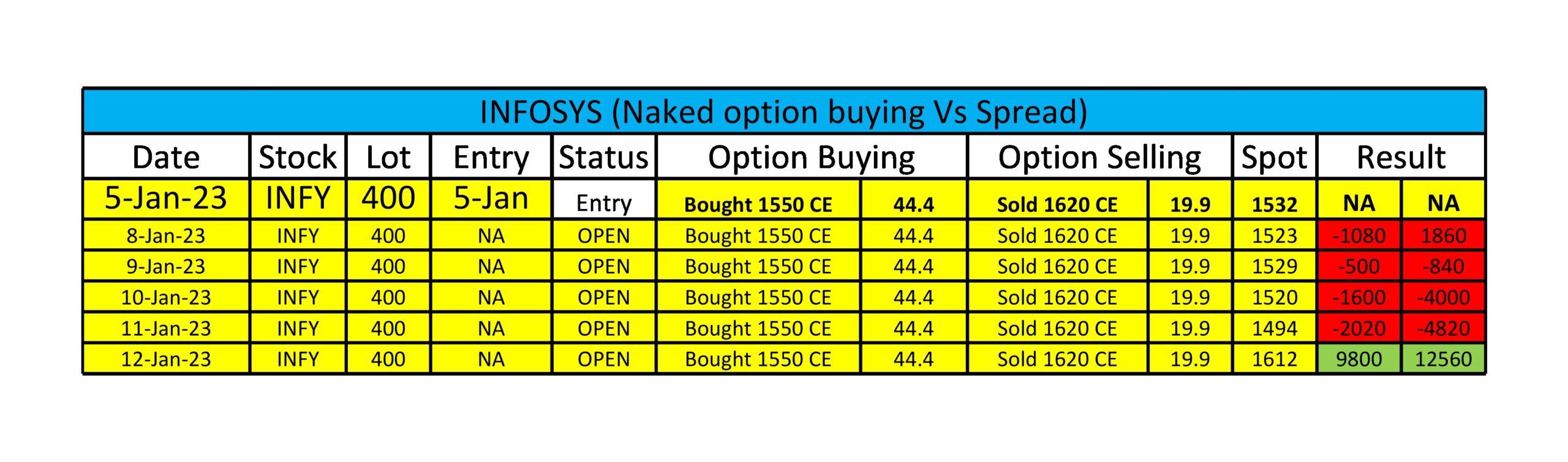

C) Debit spread example vs naked option buying Examples :-

we will study debit spread time decay & equation of time dacay & naked option buying with real trade

Debit Spread Calculation