what is Debit Spread | Bull Spread | Bear Spread

What is Debit Spread ?

Buying Higher Delta Strike & selling Lower Delta Strike

What is Spread # A spread is a strategy that involves taking opposing positions in different but related instruments(it will conists of positions that move in the opposite Direction with respect to change in market conditions,one strike trade will be profitable & other will be loss making)

What is Bull Spread # Whenever Trader buys a lower exercise price & sells the higher exercise ( Buying 100 & selling 105)

What is Bear Spread # Whenever Trader buys the higher exercise price and sells the lowe exercise price (Buying 100 & Selling 95)

Key Fetaures of Debit Spread Strategy :-

A) Focus primarily on the direction of the underlying,direction is primary & volatilty characteristics is of secondary importance

B) One option is purchased & one option is sold ( option should be of same type or same expiry

C) Trader can increase or decrease its marging of profit just by selecting the gap of strikes (more the gap,more will be & more will be reward)

D) If implied volatility is low then Purchase ATM (and buy OTM) but if implied volatility is high then its a time to sell ATM and buy ITM

comaprison of Naked option buying Vs Debit Spread

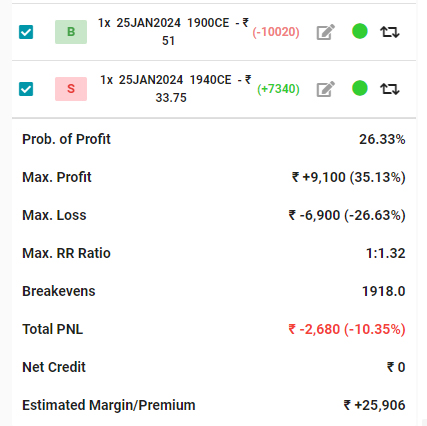

This is the Daily Chart of Kotak Bank where clear Breakout is visible, Debit Spread given Loss of 2680 after getting and Naked Option Buying given Loss of 10,020

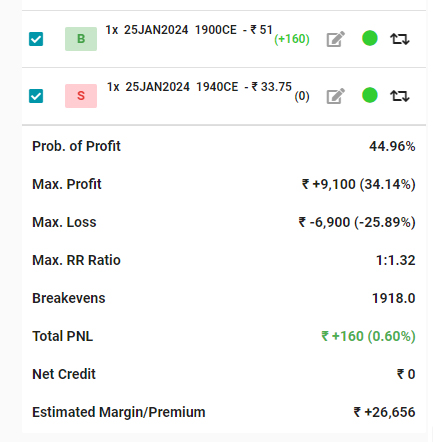

Debit Spread

Status of Trade after booking loss in Kotak Debit Spread

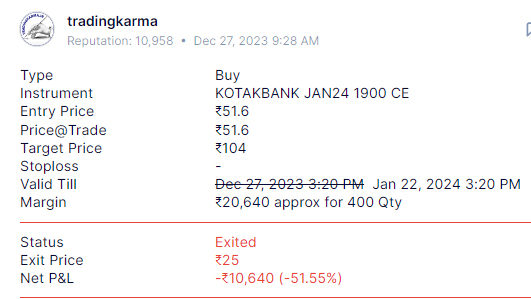

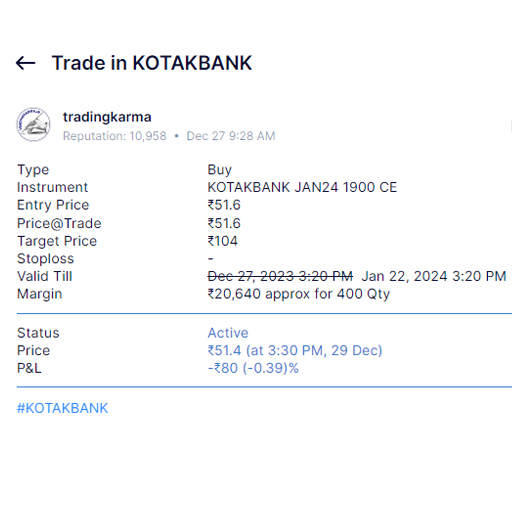

Naked option Buying

Status afte booking loss in Naked option Trade