What is Credit Spread || 13 Mar weekly Expiry

Credit Spread # If you are selling higher Delta strike(ATM/ITM) & buying lower (OTM/Deep OTM) for hedging & marging benefits.

What is Spread # A spread is a strategy that involves taking opposing positions in different but related instruments(it will conists of positions that move in the opposite Direction with respect to change in market conditions,one strike trade will be profitable & other will be loss making) || For more details click here

Click this Link to visit NSE Option Chain Data

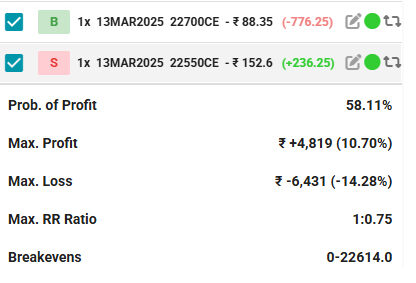

Lets discuss Mar-13 Expiry Trade using Credit Spread || Today NIFTY given strong closing || created Position in NIFTY weekly Expiry against my Long position in NIFTY heavyweight stocks ( Refer Screenshot for Details)

Trade Details

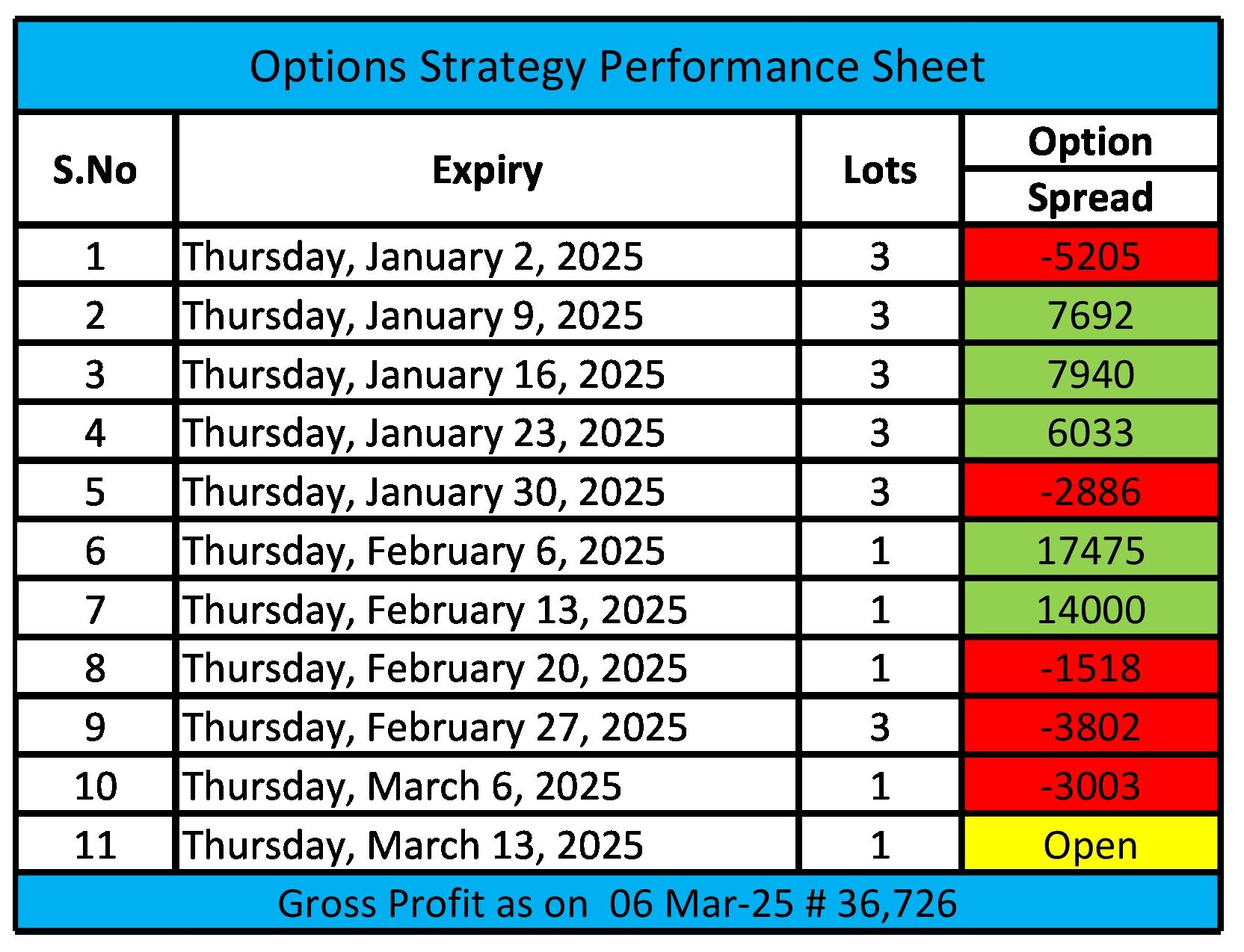

Option Trade Performance Sheet

For 9 Jan Expiry Trade details Click this Link

For 16 Jan Expiry Trade details Click this Link

For 23 Jan Expiry Trade details Click this Link

For 30 Jan Expiry Trade details Click this Link

For 06 Feb Expiry Trade details Click this Link

For 13 Feb Expiry Trade details Click this Link

For 20 Feb Expiry Trade details Click this Link

Mar-07 # Today market closed around 22552 || On Closing basis I am having Loss of 540 (Refer Scrrenshot)

Mar-10 # Today market closed around 22460 || On Closing basis I am having Profit of 1560 (Refer Scrrenshot)

Mar-11 # Today market closed around 22498 || On Closing basis I am having Profit of 438 (Refer Scrrenshot)

Mar-12 # Today market closed around 22470 || On Closing basis I am having Profit of 2295 (Refer Scrrenshot)

Mar-13 # on the day of weekly Expiry market closed well below 22550 || On Closing basis I am having Profit of 4579 (Refer Scrrenshot)