28 Mar || What is the difference between swing trading and positional trading?

Swing trading and positional trading are both popular trading strategies, but they differ in terms of time horizon, risk, and trading style.

Key Difference:

-

Swing traders capitalize on short-term market fluctuations.

-

Positional traders focus on larger market trends and hold positions longer.

Swing Trading

Time Horizon: Short to medium-term (a few days to a few weeks).

Objective: Capturing short-term price swings within a trend.

Approach:

-

Uses technical analysis (charts, indicators, patterns) to identify entry and exit points.

-

Trades based on momentum, trend reversals, and support/resistance levels.

Risk & Reward: Moderate risk, moderate reward. Requires active monitoring.

Best Suited For: Traders who can dedicate time to market analysis but do not want to engage in daily trading.

Positional Trading

Time Horizon: Medium to long-term (weeks to months or even years).

Objective: Profiting from major market trends or fundamental shifts.

Approach:

-

Uses a mix of fundamental and technical analysis to make decisions.

-

Focuses on macroeconomic factors, company fundamentals, and long-term trend patterns.

Risk & Reward: Higher potential reward but requires patience; lower trading frequency reduces transaction costs.

Best Suited For: Traders who prefer a more passive style and are comfortable holding positions through market fluctuations

===========================================

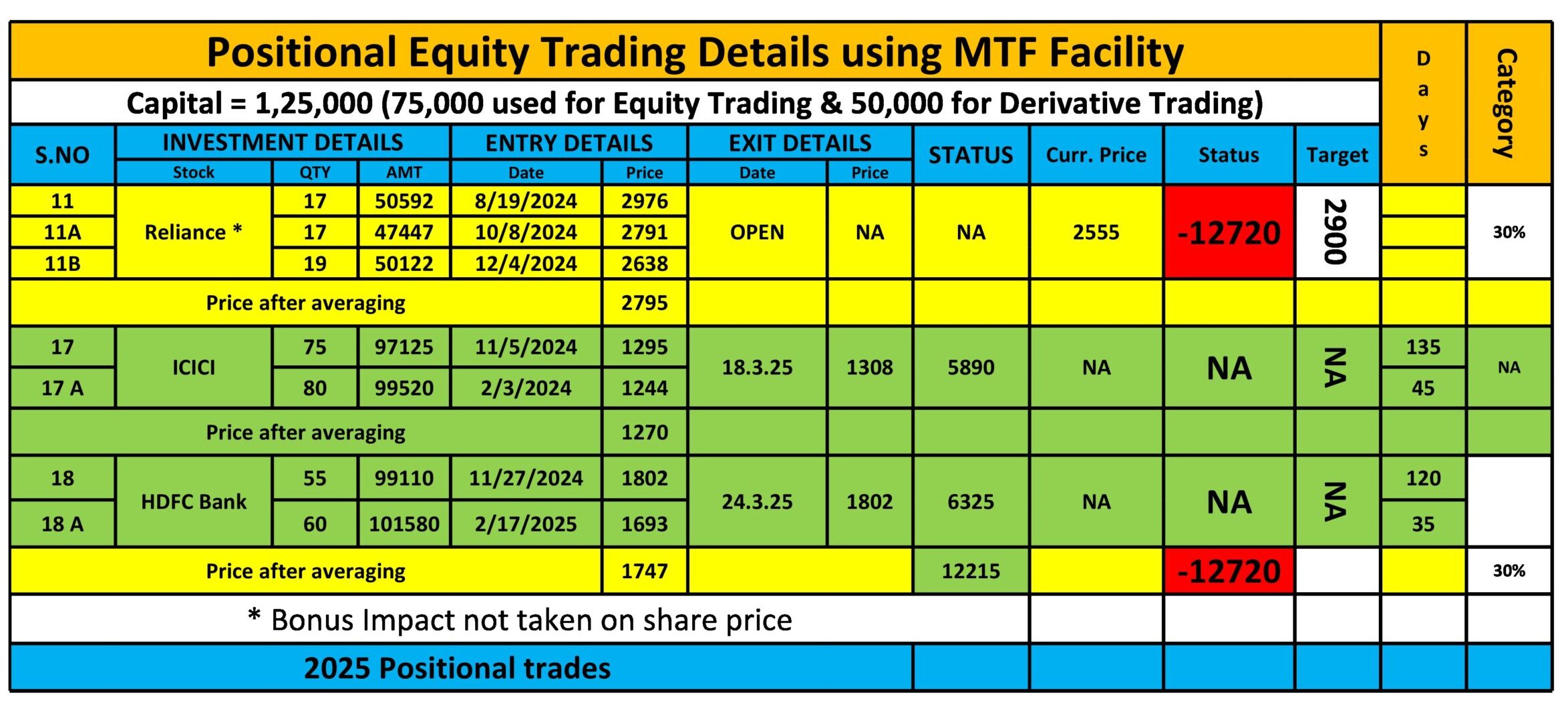

Positional Trading strategy stands for Trading Format in which traders hold their positions for a longer period and ready to do adjustments like call writing or averaging subject to the changing conditions.

(Technical Analysis is primarly used ) As per my Positional Trading strategy I take position in NIFTY TOP 10 stocks on a regular basis with a fixed traget.

पोजिशनल ट्रेडिंग रणनीति का अभिप्राय उस ट्रेडिंग फॉर्मेट से है, जिसमें ट्रेडर थोड़े लंबे समय के लिए पोजीशन बनता हैं और बदलती परिस्थितियों के अनुसार Call writing या averaging जैसे adjustment करने के लिए तैयार रहते हैं।

( Technical analysis का काफी important Role होता है ) मेरी पोजिशनल ट्रेडिंग रणनीति के अनुसार मैं एक Fixed Target के साथ नियमित आधार पर निफ्टी टॉप 10 शेयरों में Position बनाता हूं ।

For Previous Week Positional Report, Click this Link

For NIFTY Weekly Expiry Trade Details Click this Link

What is MTF or Margin Trading Facility (MTF सुविधा क्या है) ?

When you use certain amount of yours and raise remaining part from Broker this facility of Fund arrangement is known as MTF

Broker charge interest on the sanctioned amount (interest rate is usually between 9 to 15 %) it all depends upon your Broker and the Plan you are having.

जब आप अपना फंड का उपयोग करने के साथ ब्रोकर का फण्ड भी उपयोग करते है तो इसे MTF सुविधा कहा जाता है,

ब्रोकर इस सुविधा के बदले आप से interest चार्ज करता है जो की 9 से 15 (%) के बीच सालाना दर पर होता है

Last but not least never forget leverage is a double edge sword if you don’t know how to use it then its very dangerous and you can’t expect same amount of MTF on different stocks, it keeps on changing as you change the category of Stock

हमेशा ध्यान रखे MTF सुविधा एक दोधारी तलवार की तरह अगर आपको इसका सही उपयोग नहीं आता तो यह रिस्की भी साबित हो सकती है और हमेशा ध्यान रखे यह सुविधा सब स्टॉक्स पर नहीं मिलती और सब स्टॉक्स पर एक जैसी भी नहीं मिलती ( यानि किसी पर काम किसी पर जायदा और किसी पर बिलकुल भी नहीं)

To know NIFTY Top 10 Stock Click this Link

Click here for 2023 Performance sheet

Click here for 2024 Performance Sheet

Basic Structure of my model:-

A) CapitalRequired 1,00,000 (or above)

B) Divide this Capital into two parts,

C) Use 75,000 for Positional Trading in NIFTY Top 10 Stocks,

D) Use 25,000 for Derrivative Trading,

E) Use MTF for higher return in Positional Trading,

F) Use any Risk defined strategy for Derrivative Trading,

- Please Check the Below given Performance Sheet for Positional Trades…

- Total Trades since Jan-1 2023 # 57 ( 32 + 21 + 4 )

- Average Holding day # 45 Days

- “A” Category Trade ( Profit Booked within 30 Days) # 19 + 6 = 25

- “B” Category Trade ( Profit Booked within 30 to 60 Days) # 6 + 7 + 2 = 15

- “C” Category Trade ( Profit Booked above 60 Days) # 7 + 8 + 2 = 17

===============

Right now I am having open Position in Reliance

Booked Profit between Jan-1(2023) to 31 Dec-(2023) #76,379

Booked Profit between Jan-1(2024) to 31 Dec (2024) # 47,816

Booked Profit between Jan-1(2025) to as on Date # 12215

Unrealised Loss in Open Position Mar-28 ( 2025) # 12720

POSITIONAL TRADE PERFORMANCE SHEET