How to do hedging with NIFTY

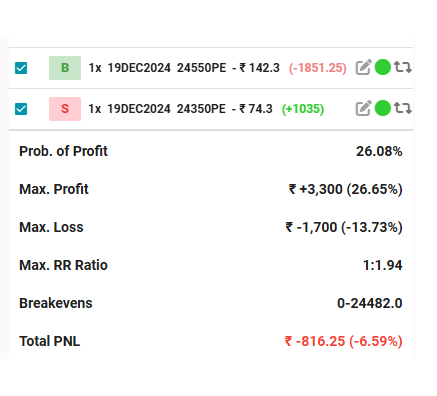

I have created short position in NIFTY as hedging against my Long position in NIFTY Heavyweight (HDFC Bank + Reliance + ICICI Bank). On Dec-12 around 3.15 I have created Debit Spread in NIFTY, Bought 24550 CE (ATM) and sold 24350 CE (ITM). Refer under given table for more detail ||

मेरी NIFTY हैवीवेट (HDFC बैंक + रिलायंस + ICICI बैंक) में लॉन्ग पोजीशन है,हेजिंग के तौर पर NIFTY में शॉर्ट पोजीशन बनाई है। 5 दिसंबर को लगभग 3.15 बजे मैंने NIFTY में Debit स्प्रेड बनाया, 24550 CE (ATM) खरीदा और 24350 CE (ITM) बेचा। अधिक जानकारी के लिए नीचे दी गई तालिका देखें

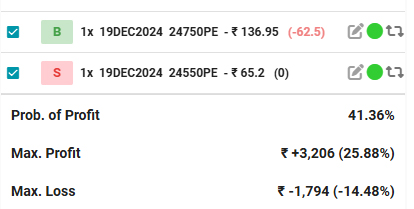

13 Dec # NIFTY given 221 Points Move,Loss Booked and Creted New Spread. Refer below given Table

Details of New Debit Spread

16 Dec # Market Corrected 100 Points today, on closing basis I am having Profit of 570 in this Spread.

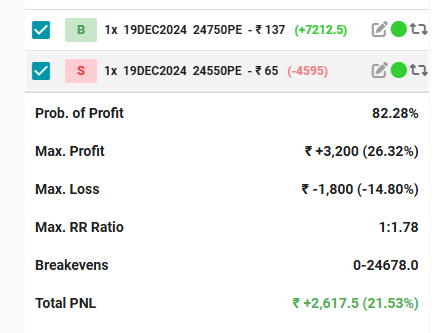

17 Dec # Market corrected 332 Points, Bokked profit in Trade-2 around 2617 and Creted new Spread refer Screenshot

Details of New Debit Spread

18 Dec # Today Market corrected 137 Points. On closing basis I am having Profit of 725 in this Trade

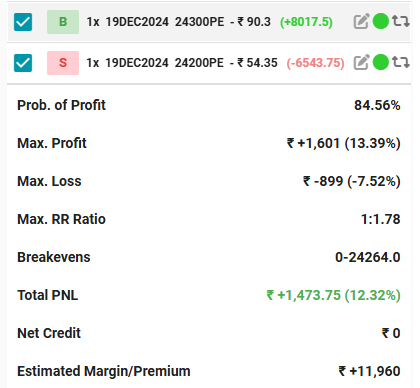

19 Dec # Post Fed Mkt outcome Market Opened Gap down, Booked My Profit (around 1500, Refer screen shot)

Outcome of All Three Trades (Profit of 3274) :-

Spread-1 # Loss of 816

Spread-2 # Profit of 2617

Spread-3 # Profit of 1473