trading in nifty weekly expiry || 2 Jan 2025

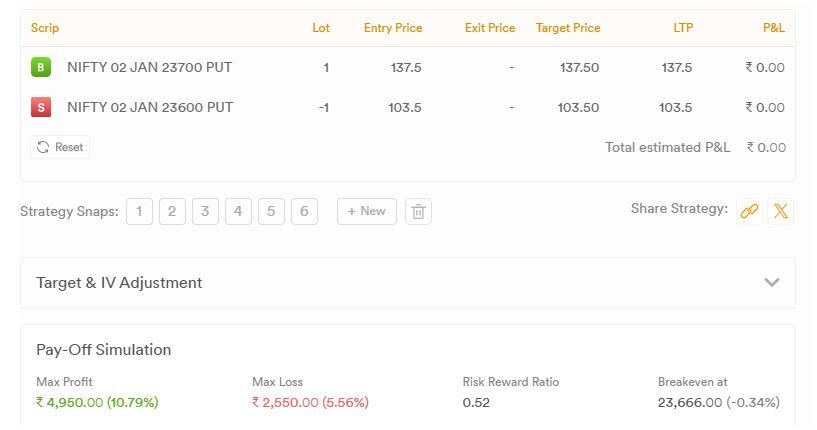

Trading in NIFTY weekly Expiry requires a skill special set, commond over technical and Risk and Reward ratio matters || NIFTY closed around 23750 for hedging purpose I have created Bear Spread in NIFTY, bought 23700 Put @ 137.75 and sold 23600 Put @ 103.5 || Maximum Profit in this Trade # 4950 and Maximum Loss in this Trade #2550

Trading in NIFTY weekly Expiry के लिए विशेष कौशल की आवश्यकता होती है, तकनीकी और जोखिम और इनाम अनुपात के मामले में समानता होती हैआज NIFTY 23750 के आसपास बंद हुआ, हेजिंग के उद्देश्य से मैंने NIFTY में बियर स्प्रेड बनाया है, 23700 पुट @ 137.75 खरीदा और 23600 पुट @ 103.5 बेचा || इस ट्रेड में अधिकतम लाभ # 4950 और इस ट्रेड में अधिकतम हानि # 2550

For Previous Expiry Trades click this Link

For Option Table and related Details, visit NSE Site

27 Dec # Today NIFTY Closed around 23832 and on Closing basis I am having Loss of 754, carry forward Trade for the next day

30 Dec # It was a quite volatile day, NIFTY closed on a negative side. On CLosing basis I am having Profit of 850 apx ,carry forward Trade for the next day

31 Dec # It was a Flat Closing, on a Closing basis I am having Profit of 450, Carry forward Trade for next day

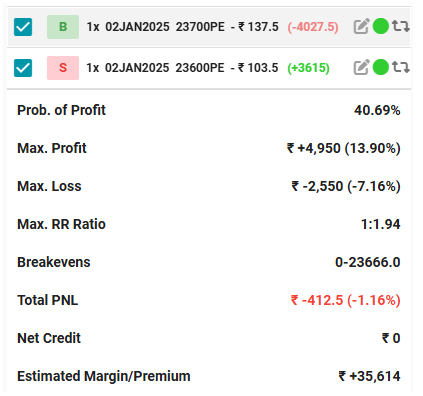

01 Jan # Today Nifty given Positive closing of more then 100 Points Booked Loss (412 rupee) in the runing Trade and created new sprerad, Refer Images

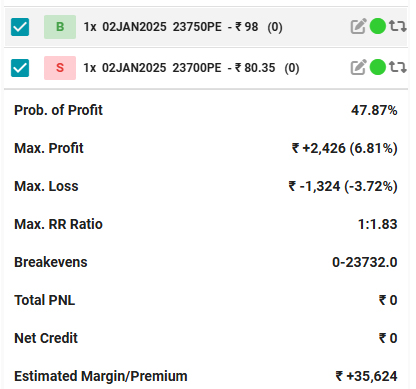

Details of New Spread :-

02 Jan # Today Nifty given 445 points sharp rally, on Closing basis I was having a Loss of 1323

Outcome of all Trades (Loss of 1735) :-

Loss in Trade-1 # 412

Loss in Trade-2 # 1323