Learning

What are option Stratagies for option Seller

Popular Option Strategies can be categorised as under :-

- Covered Call ( Selling OTM Call)

- Credit Spread

- Credit Ratio Spread

- Butterfly

- Iron condor

Lets explain this strategy in simplel Lenguage

Covered Call # selling OTM (out of the money call), usually Investors creates this positions to make some extra income (or some additional rental) income from their holdings

Example # Suppose you have holding of HDFC Bank (it would be better if qty is near to 1 Lot or 550 Share) and price is running around 1600, one can sell OTM Call (eg. 1640 or 1660) and can generate some additional income without selling the stock, IT just like Rental Income from property

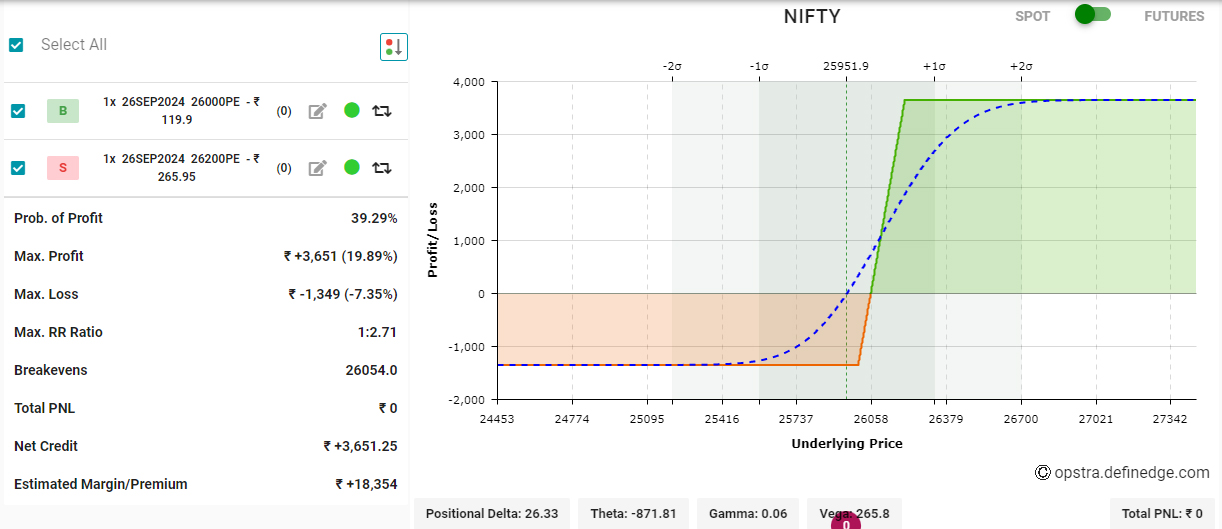

Credit Spread # Selling higher Delta (or higher value strike) and buying Lower Delta (or Lower value strike) for hedging

Butterfly #