how to trade Nifty weekly Expiry | 22 Aug

Expiry Trading is quite popular these Days. Nifty weekly Expiry is held on every weekly Thursady. Being Directional Trader I try to predict move (Bullish/Bearish) for next few days(till weekly expiry). most of the time I use Credit Spread for trading NIFTY weekly Expiry. For 22 August I am expecting 300(+) point move in the NIFTY on the Long side. Lets understand this concept with the help of Chart and option Strategy (using Opstra)

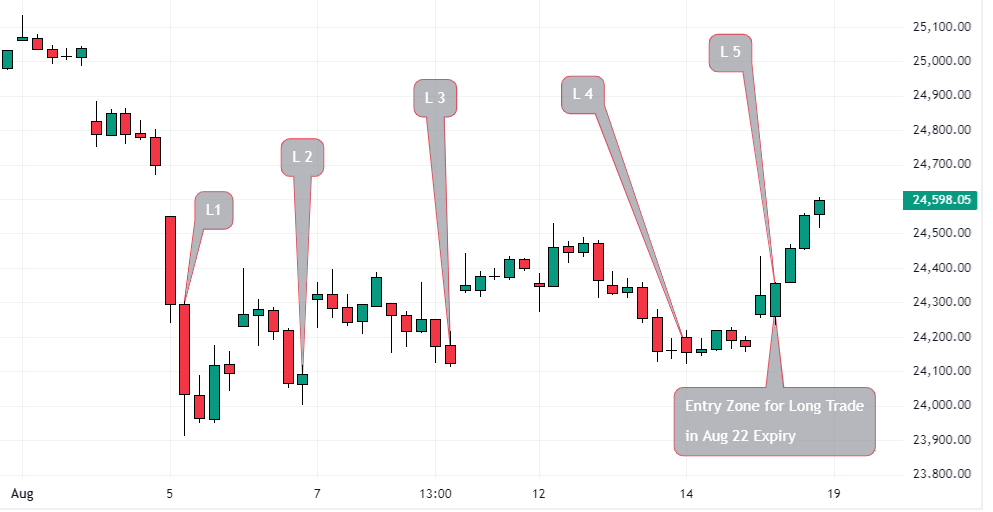

NIFTY Future Chart (75 Min)

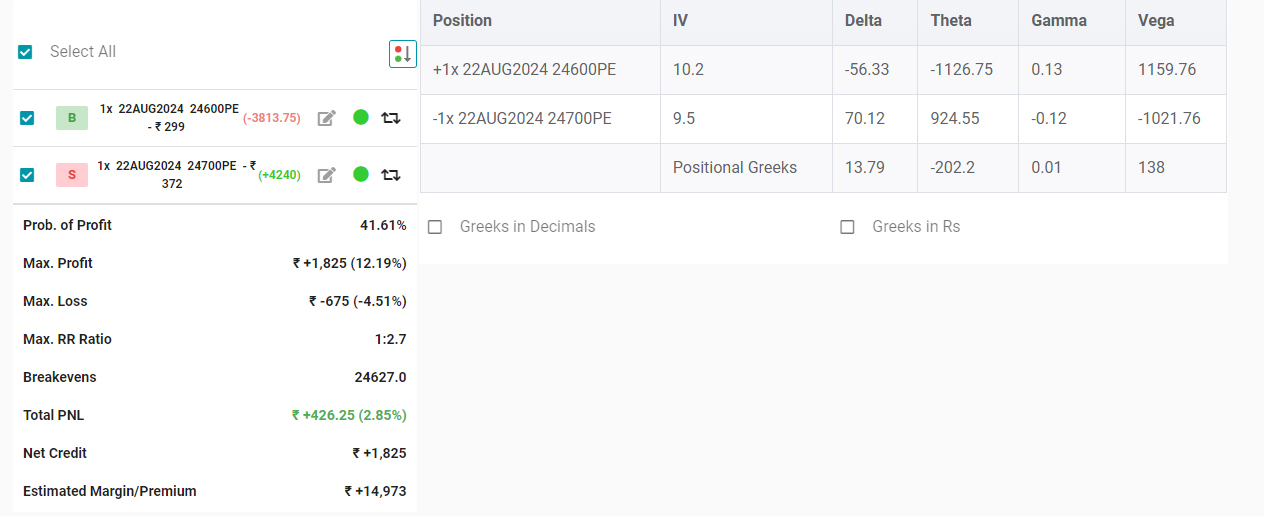

Credit Spread Spread Strategy / Taking Risk 1% of Base Capital (50,000)

Trading Details :-

16 Aug #

Day-1 of weekly Expiry, Nifty opened strong thanks to global cues ( I was having bullish view since 14 Aug in NIFTY, created a Long position but didnt do well) my view for NIFTY is clear its respecticg its Lower Base and trying to create Higher High.

Around 11.45 I decided to create Long position in NIFTY, Sold 22700 PE (ITM) and Bought 22600 PE for hedging purpose. (at this time NIFTY Spot was trading around 24332) and I am expecting 300 (+) points move for Aug-22 Expiry

Risk Reward Ratio in this Trade is 1 : 3

19 Aug #

Day-2 of Weekly Expiry, Open & high was almost equal and market remained under this range throught the day, last few minutes huge volume has been noticed, Profit on Closing basis # 322

20 Aug #

Entire day Market was Strong. Profit on Closing basis # 825

21 Aug #

Market was strong and closed above 24700. Profit on Closing basis # 1465

22 Aug #

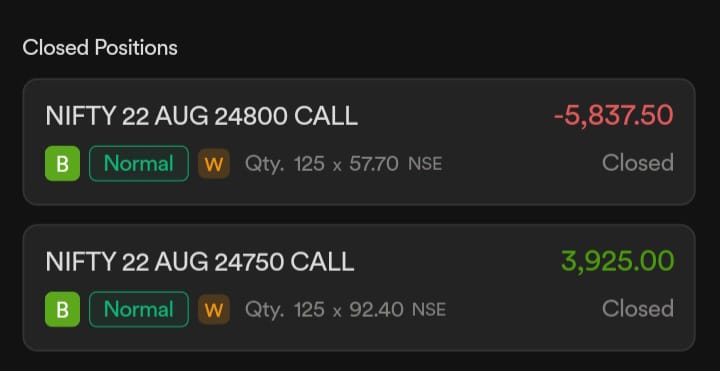

Created Short position in Nifty (9.30) for intraday which resulted into Loss…