NIFTY Analysis

Nifty weekly Expiry swing Trade | 14 Aug

Between Previous weekly expiry (Aug-02 to Aug-08) we have seen NIFTY was under pressure but on the Lower level NIFTY was respecting its base and making higher Low and trying to challenge upper level. On Friday in Second Half I have Created Long position in NIFTY (Refer Chart, Option details, commentry)

- Aug-09 # I have created Long position in NIFTY, I am Bullish on NIFTY for this week expiry as Thursay is a NSE Holiday ( Independence Day), this expiry is scheduled on Wednesday

- Aug-12 # Today NIFTY gap down then shown some recovery, on closing basis I am having Loss of 422

NIFTY 75 Min. Chart

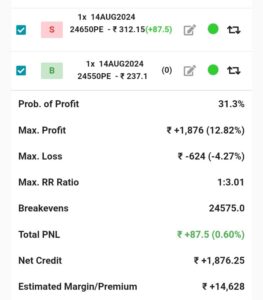

Credit Spread

Aug-13 # My original position which was created on Friday but on tuesday when I realised NIFTY is not making strong move ( on upper side), decided to short NIFTY created Short position with Spread ( Reffer below given details)

Sold 24300 CE & Bought 24350 CE for hedging