Positional Trading strategy | Jan-01 to Sep-21

Positional Trading strategy stands for Trading Format in which traders hold their positions for a longer period and ready to do adjustments like call writing or averaging subject to the changing conditions. (Technical Analysis is primarly used and if you are comfortable with the fundamental of the sectors it also gives you an added advantage.) As per my Positional Trading strategy I take position in NIFTY TOP 10 stocks on a regular basis with a fixed traget and do averaging if requires in Last 20 months this sysstem delivers almost 40 to 100 % return subject to the Trading activity and usage of MTF (Margin Trading facility).

For previous year Performance sheet click this Link

To know NIFTY Top 10 Stock Click this Link

Let’s understand this Model with an example, suppose MR A is having 1 Lakh rupee and he wants to starts his Stock Market journey, I will suggest him to follow the under given Steps: –

- Open a Bank FD account or any Debt instrument where he can get secured return (7 to 9 %) per annum,

- Raise an OD limit against the same Fixed Deposit or Debt Instrument (usually one can get 90 % of the security),

- Now divide this 90 thousand into 6 Parts (15000 X 6),

- Shortlist some fundamentally strong company as I have shortlisted NIFTY Top 10 Company for Positional Trading

- If you find Trading opportunity in these stocks deploy only 1/6 part of your capital (15000) and raise remaining 45,000 from Broker under the Provision of MTF

- This Model has given us 40 to 100 (%) return in last 21 months depending upon the usage of MTF & Trading Activity,

- Please Check the Below given Performance Sheet & Comparison Sheet

===============

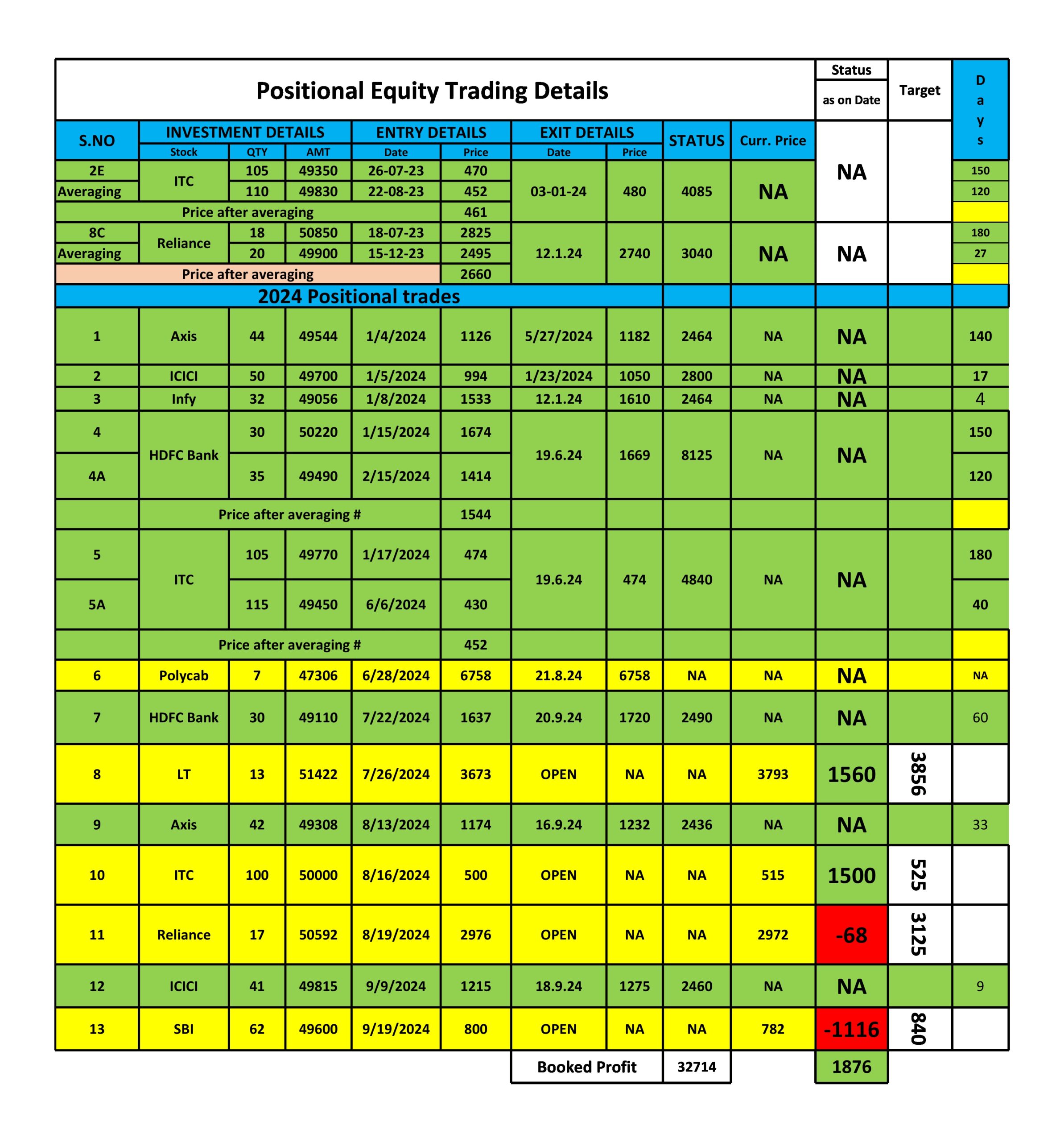

Right now I am having open Position in L&T, ITC , SBI and Reliance

Booked Profit between Jan-1(2023) to 31 Dec-(2023) #76379

Booked Profit between Jan-1(2024) to 14 Sept (2024) # 32714

Unrealised Profit in Open Position # 1876

Positional Trade Report

What is MTF or Margin Trading Facility?

When you use certain amount of yours and raise remaining part from Broker this facility of Fund arrangement is known as MTF and Broker charge interest on the sanctioned amount (interest rate is usually between 9 to 15 %) it all depends upon your Broker and the Plan you are having.

Last but not least never forget leverage is a double edge sword if you don’t how to use it then its very dangerous and you can’t expect same amount of MTF on different stocks, it keeps on changing as you change the category of Stock